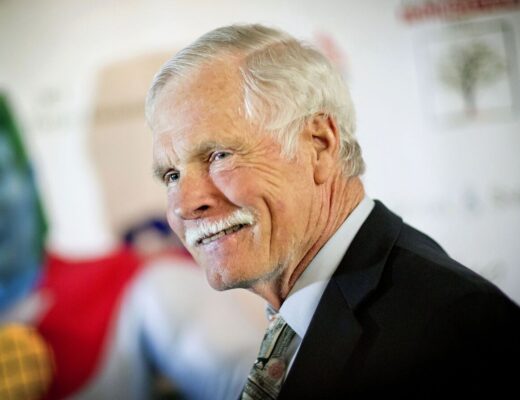

Who is Ben Graham and his professional activity

Ben Graham, despite not reaching a huge fortune, made an undeniable contribution to the formation of the financial market and its theory. He developed the concept of value investment, and was also a teacher of Warren Buffett. The latter spoke about Graham as his mentor, and even named his first son after him.

Ben was born in 1894 in London, and a year later his family moved to the United States. The real name of the outstanding economist was Grossbaum. His father died when the boy was 9 years old, and his mother had to open a home guesthouse; at the same time she was engaged in stock trading. In 1907, there was a crisis in the banking sector, and all investments were lost. This situation became exemplary for Graham, and he realized that investments should be made after careful consideration of the situation.

Thanks to a scholarship, a 16-year-old boy entered the University of Columbia. After graduation, he went to work in a brokerage firm, where he started as a courier and then became a business partner.

In 1923, together with his classmates, Graham created the Graham Corporation investment company. Business was going well, but Ben pulled many processes on himself. He offered partners to pay him not a salary, but a percentage of the profit, which would be formed upward – from 20% to 50%. Colleagues did not like this scheme and the business was closed. Graham opened a company Benjamin Graham Joint Account, after a time he was joined by the brother of a friend of the economist and the firm was transformed into Graham-Newman Corporation, where Warren Buffet came to work a few years later.

Graham started his business on Wall Street at the age of 20, and he had neither the experience nor the capital. And at that time the stock exchange and the stock market itself were working rather chaotically, and the regulatory body in the form of the Federal Reserve had just appeared.

After working as a clerk at a brokerage firm, Ben began studying the financial statements of railway and industrial companies. He read analytics and traded in stocks on its results. At the time, these securities were considered an instrument exclusively for speculators, and investors worked with bonds. Graham believed that the basis of any operation on the stock exchange should be the safety of capital. It is necessary to get a high yield without taking a big risk and without using speculative instruments. To achieve this, it is necessary to analyze the industry and understand how the company functions and its peculiarities. One should not pay attention to the mood of speculators, it is important to turn off emotions and concentrate on statistics and figures.