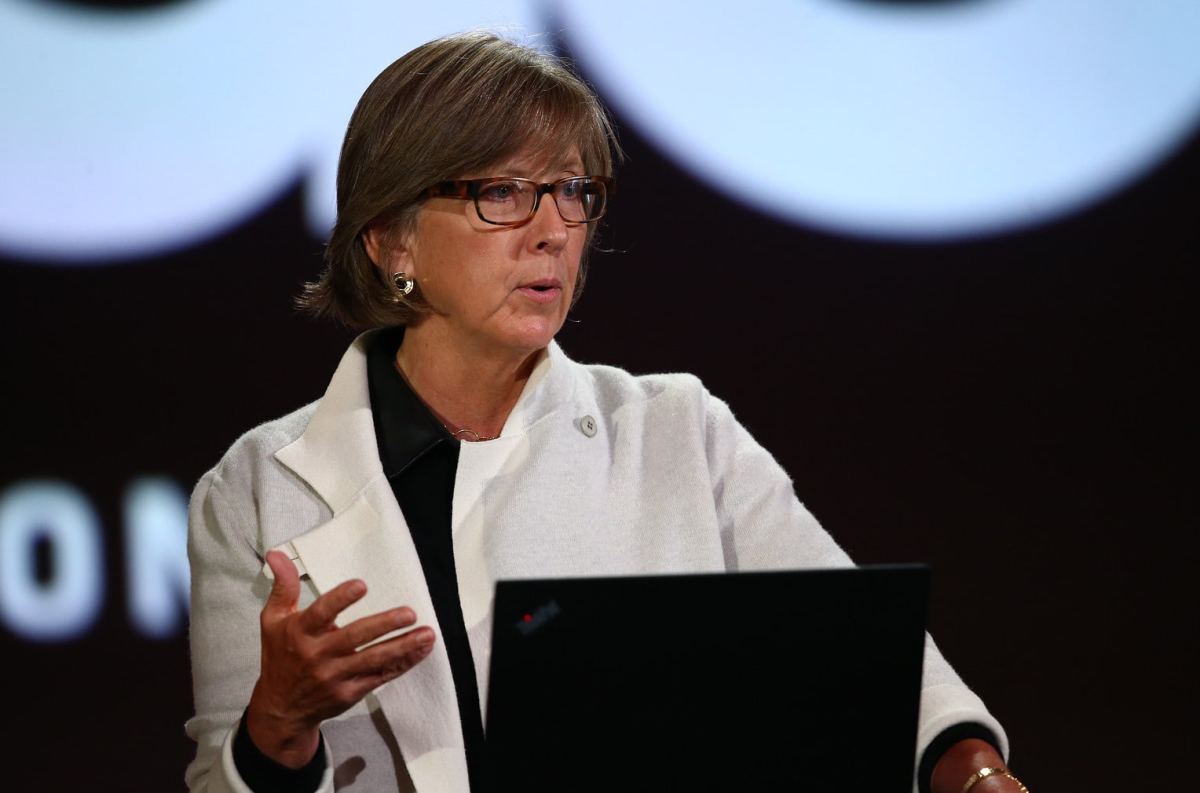

How did Mary Meeker succeed in venture capital investment?

Financial analyst Mary Meeker became known in the 90s. She was the one who showed the world the potential of the Internet, the attractiveness for Silicon Valley investments. A unique approach allowed Meeker to become a professional, and love of business brought success.

Mary worked for a long time on Wall Street at Morgan Stanley, but her passion was venture capital investment. And after 20 years of successful career, Meeker plunged into a new field and became a partner at Kleiner. She was the head of the Digital Growth Fund and made deals with industry giants such as Twitter and Facebook.

While Mary’s line of business is venture capital investment, her approach combines the fundamentals of financial analysis. She calculates the development model for each company based on numbers.

Mary’s love of investment owes her father, who worked as a top manager at a steel plant in Portland. Back in high school, she took an investment course and invested for the first time, choosing a company that produces refrigerators. After 3 months, her shares doubled.

After graduation, Meeker took a job as a broker at Merrill Lynch. After getting an MBA degree, after working for Salomon Brothers, which was engaged in investment, Mary moved to Morgan Stanley, a branch that specialized in personal computers.

In 1994, her interest in the Internet grew. Morgan Stanley became an investor in Mosaic Communications startup and their product Netscape, the first browser. Investments brought good profits, and Micker’s influence was growing. She presented market reports and recommendations every six months, and this analysis was a kind of instruction for investors. Surprisingly, Mary’s forecasts came true almost with absolute accuracy.

The analyst was respected by many executives of IT companies in Silicon Valley. She was fully trusted, although at times this led to negative consequences.

When Meeker took up her position at Kleiner, she chose her strategy. She invested in both well-known companies and young but promising start-ups. A vivid example of a successful investment is the system for payment transactions Square, which was developed by Jack Dorsey, known as the founder of Twitter.

Despite the fact that it is Mary Meeker who owns the discovery of all the advantages of the Internet, she cautiously chooses the company for investment. According to the analyst, the majority of Internet projects are overvalued, which can negatively affect the reputation and income of venture funds.

Mary continues to publish reports, where she emphasizes the change of trends in the market for the worse. But in spite of it the Internet continues to be a potential sphere, which brings positive innovations in different spheres of life.