Stanley Druckenmiller: career as head of Duquesne Capital

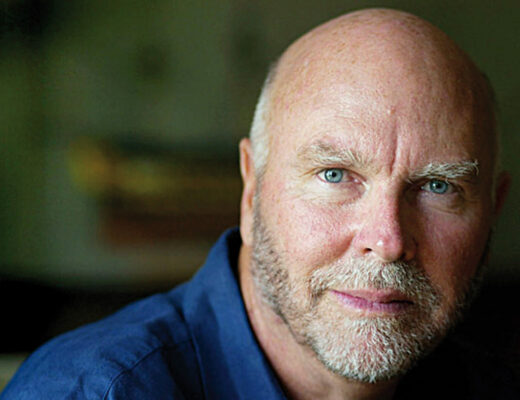

Stanley Druckenmiller is best known as the founder of the Duquesne Capital hedge fund. He also managed George Soros’ funds as part of Quantum. In addition to his investment activities, Druckenmiller is a philanthropist. Together with his wife, he supports various social projects aimed at helping those in need.

Druckenmiller was born in 1953. When he was in primary school, his parents divorced, and Stanley moved from Philadelphia to a small town in New Jersey with his father. He graduated in 1975 with a bachelor’s degree in English and economics. Druckenmiller planned to continue his studies in economics at the University of Michigan.

At the same time, he landed an internship at the Bank of Pittsburgh. There the ambitious young man was noticed by a manager, Spurs Drelles, who offered him an oil sector analyst position. By 1978, Stanley had become head of research. The young man immersed himself as much as possible in investment activity, trying to understand its peculiarities. His efforts were rewarded: 3 years later, he took over from his mentor Drelles. Stanley made considerable profits for the bank by breaking the rules of diversification. He invested 70% of the department’s funds in the shares of oil companies – a winning move.

Own business

He worked for the bank until 1981 when he set up his own firm, Duquesne Capital. While managing the fund, Stanley became an advisor to Dreyfus in 1985 and three years later was poached by George Soros to join his Quantum fund. Druckenmiller helped the investment giant make more than US$1 billion on Black Wednesday, which led to the collapse of the Bank of England. Stanley left Quantum in 2000 when his bets on the technology sector led to heavy losses for the firm. He then focused his energies on Duquesne.

In 2010, the financier announced his intention to close the fund, saying he was tired of the constant stress and management of huge amounts of capital. During its existence, the fund had an average annual return of 30% and no losing periods.

Druckenmiller’s strategy is similar to Soros’. In this case, some stocks are long, some are short, and leverage is used for futures and foreign exchange transactions.

Druckenmiller continues to invest and analyse. In 2020, he predicted a rise in US inflation caused by the Fed’s ill-advised actions.

Stanley is also involved in philanthropic activities. In 2009, he donated US$705 million to projects focused on medical research and poverty alleviation.