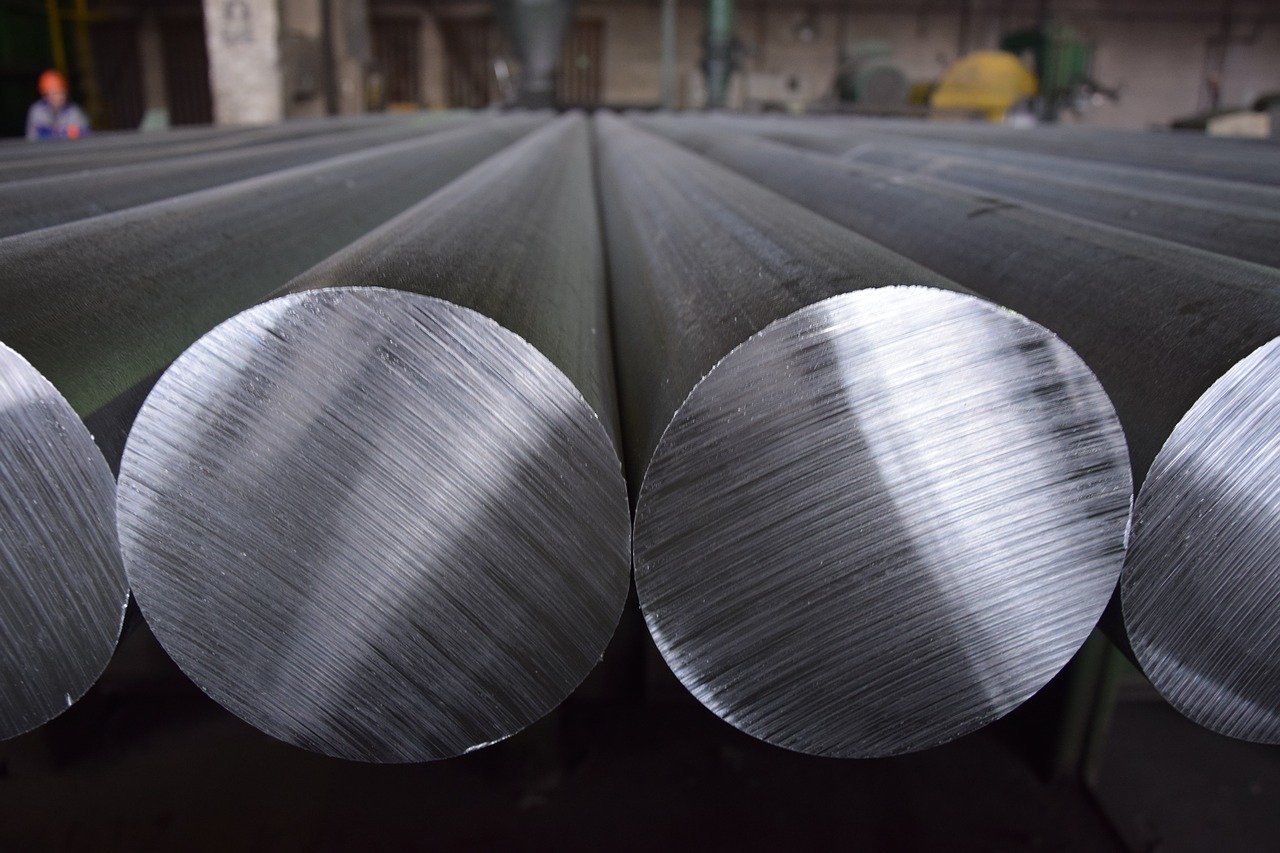

Reasons for rising aluminium prices on the world market

The global economy continues to recover and countries are ramping up production, which requires more raw materials. In assessing market trends, analysts at Otkritie Broker predict a rise in aluminium prices.

However, experts note that the cost of the metal may fall in the medium term, but if we consider the situation in the long term, aluminum will rise in price. During the pandemic, demand for the metal, like other commodities, declined. As soon as China recovers from the crisis, it actively procures resources for the rapid recovery of domestic processes. This interest on the part of the superpower caused a real stir on the commodity markets.

Commodity prices have jumped to record levels for the last 3 years. The reason is the growing demand from China, which continues to expand its production. Imports into the country increased by 38%, and exports reached nearly 31%. Aluminium futures on the Chicago Mercantile Exchange reached $2,313.7, the highest since June 2018. On the London Metal Exchange, the price of a tonne of raw material with delivery in three months rose by 1.37% to $2,293. At the same time, the price also fluctuated to $2,304, which was a record high since the same June 2018.

According to analysts, aluminium prices have reached a resistance level at $2,300 per tonne. In this case there is a high probability of a downward correction of the price.  For a while after the pandemic, the raw materials market felt insufficient demand, but this pressure is now gradually subsiding. Experts note that there is a surplus of raw materials, but the amount is gradually decreasing.

For a while after the pandemic, the raw materials market felt insufficient demand, but this pressure is now gradually subsiding. Experts note that there is a surplus of raw materials, but the amount is gradually decreasing.

As for the long-term outlook for aluminium, it is assessed as positive, primarily due to the news from China. The fact is that the country’s government has adopted a strategy to reorganize production facilities in order to reduce harmful emissions into the atmosphere. This, in turn, has led to a reduction in the volume of Chinese aluminium entering the global market. Furthermore, raw materials are an important component in achieving climate goals not only for the PRC, but also for other nations. However, a decrease in production is to be expected, albeit only by a small amount. At the same time, costs in the segment will increase which will be one of the factors to maintain an uptrend in the market. In the long term, aluminium prices will continue to rise, while the medium-term outlook is for a short-term decline.