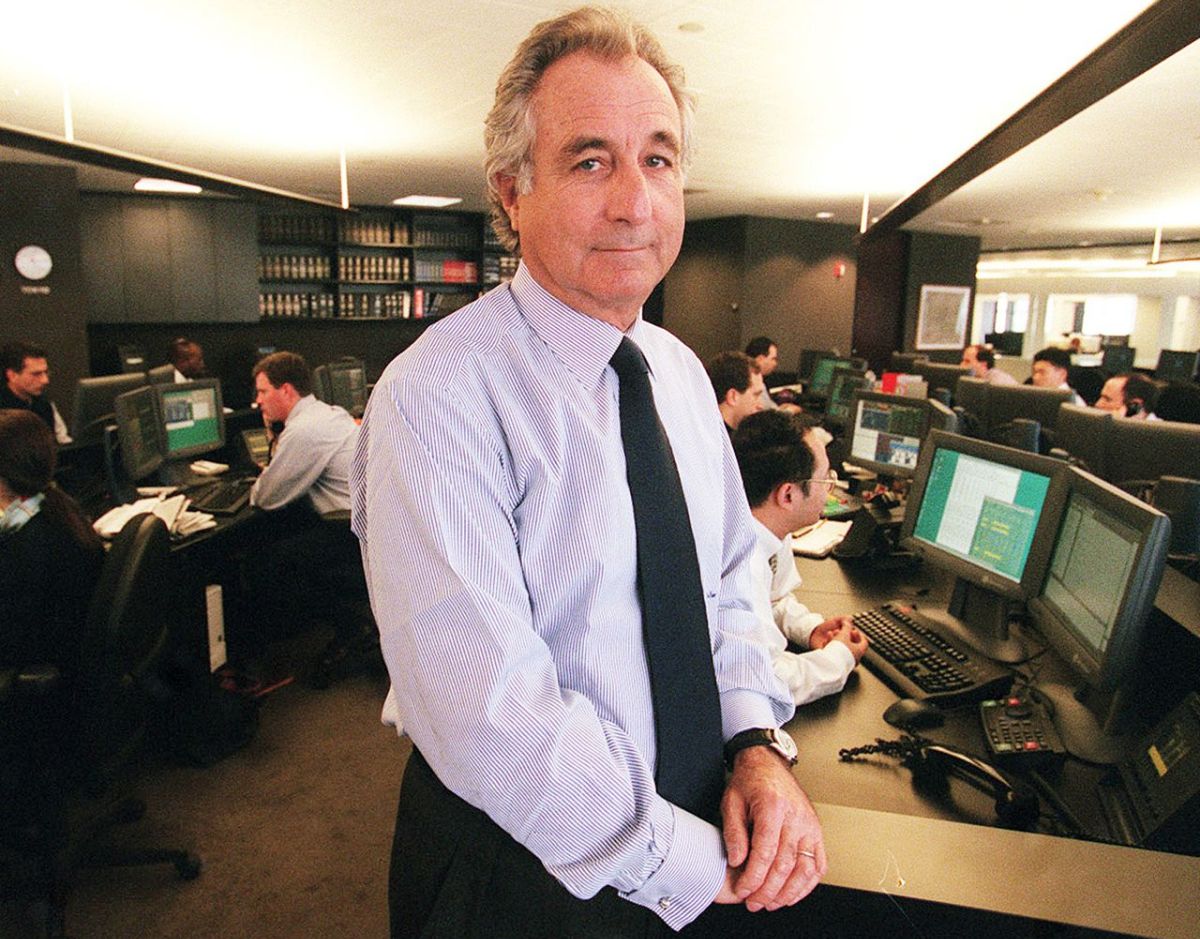

How Bernard Madoff created the world’s largest financial pyramid

Bernard Madoff is famous all over the world not for his business success, but for his large-scale financial frauds. He was sentenced to 150 years for his crimes, but his scam went down in history and deserves special attention.

Bernard Madoff was born in 1938 in New York to a Jewish family. He studied at the University of Alabama, and then moved to Hofstra, where he received a bachelor’s degree in political science. During his student years, Bernard began working as a part-time employee, and the accumulated money of 5 thousand dollars became his start-up capital for his own business. His investment firm was called Madoff Investment Securities, and to open it, the businessman borrowed $50,000 from his father-in-law, who was a financier. His wife’s father supported Madoff, helped to attract acquaintances to the company, and soon the business went up. Investors actively invested money in the company, but the competition in the market was high. At that time Bernard was the first to introduce the possibility of electronic trading. In 1980, Madoff Investment Securities’ transactions accounted for 5% of the total volume on the New York Stock Exchange.

Investors were guided by the authority of the company and Madoff itself and invested finances at 12-13% per annum. Moreover, if a person had doubts, Bernard promised to return the money, thus calming the client. His investors were such famous people as John Malkovich, head of L’Oreal Corporation, anchorman Larry King and others. In addition, Madoff was engaged in charity, which also earned him and his business credibility.

However, the activities of the company and its investors were tightly controlled. Investors could not get online access to their accounts, and all data was sent via email. And the interest always came on time. The company operated under the Ponzi scheme, when some depositors made a profit thanks to the funds of others.

Not everyone trusted Madoff. Gary Markopoulos repeatedly asked the commission that he was engaged in securities, to check the business. A financial analyst argued his requests that Madoff Investment Securities could not make such large profits legally. However, no one paid attention to the expert’s request.

The crisis of 2008 disrupted the success of Bernard Madoff’s business. No new capital was injected and the profit payment was over. Then the businessman confessed to the family that his company was in fact a financial pyramid. Bernard’s sons reported their father to the police, and in 2009 he was sentenced to 150 years in prison. The depositors’ accounts were about 65 billion dollars short.