Aluminum prices are changing amid the new tariff policy

At the beginning of 2025, aluminum prices fell by 3%. However, after a few months, the trend changed. Harbor estimates that the cost of raw materials will continue to rise. Analysts expect the price of the metal to rise by 21% by the end of 2026.

The research company cites several factors putting pressure on the market. One factor is the limited supply on the global market. At the same time, demand from American buyers is growing. This excitement is caused by Donald Trump’s administration’s new tariff policy.

According to Jorge Vázquez of Harbor, the cost of futures on the London Stock Exchange will reach US$3,000 within the next 18 months. This figure will exceed June prices by 22%.

Market trend overview

Not all experts agree with Harbor’s vision for the sector’s development. For example, Goldman Sachs forecasts a decline in aluminum prices to US$2,100 per ton by 2026. The emergence of bullish sentiment is linked to the White House’s new tariff rules. Analysts believe the US government’s policy is stimulating inflation. This, in turn, leads to a slowdown in economic development. The current market situation is as follows:

1. Tariffs on aluminum and steel imports have reached 50%, up from 25% previously.

2. Donald Trump claims that the tariff increase will boost the profitability of the domestic metallurgical industry.

3. The president is confident that this will stimulate investment in American production facilities.

4. According to Morgan Stanley, in 2024, aluminum imports to the US accounted for 80% of total consumption.

Vázquez predicts that global demand for raw materials will grow against the backdrop of existing US trade agreements. However, China does not plan to increase aluminum production, despite growing demand. Other countries, meanwhile, are demonstrating greater flexibility in managing the balance of supply and demand.

Analysts’ expectations

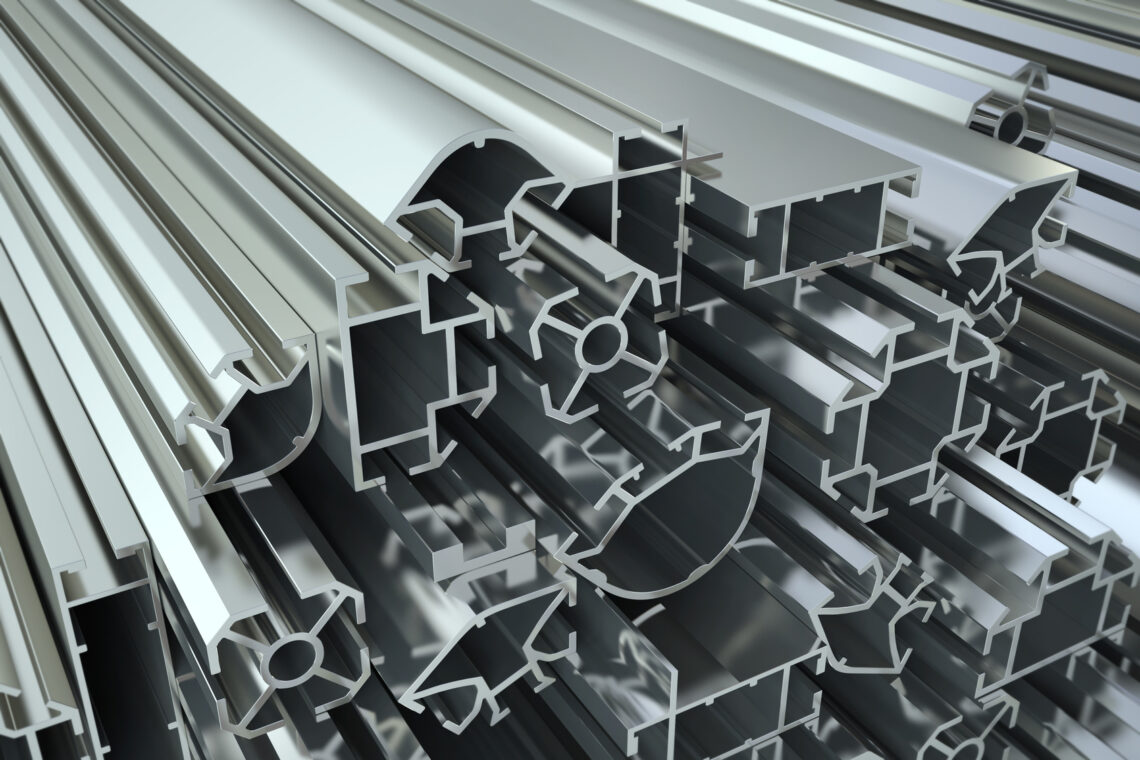

The sustained growth in interest in aluminum is expected to create market tension. In the coming years, supply may not keep pace with demand. Some industries are already feeling the pressure. Construction companies, for example, warn that higher aluminum tariffs will lead to higher prices for key building materials. Aluminum is a key raw material for the aviation industry and for producing household appliances, automobiles, and other products.

Harbor forecasts that the premium for aluminum in the Midwest region will almost triple to 54 cents per pound in 2025. In 2026, it will exceed 84 cents per pound. Notably, the main production facilities are concentrated in this region.

Vázquez believes that local enterprises’ profits should increase. Due to high tariffs, consumers will find it unprofitable to purchase metal on the global market. Consequently, demand for American aluminum will grow.