Will there be an oil storage facility in the world with such production volumes?

The oil market is experiencing shock after shock, exchanges do not have time to react to the fall in quotations. In addition to low fuel prices, there may be another difficulty – soon we will have to look for an oil storage facility in the world, the number of available ones is decreasing.

A well-known energy trader Gunvor has conducted an industry analysis, as a result of which it becomes clear that almost all ground facilities for oil storage and tankers are occupied. The production of raw materials is active, fuel is bought on the spot market in large volumes, taking advantage of the fact that here the cost is lower than when purchasing under futures contracts. This trading option gives an opportunity to get additional benefits. Buying oil at a low price, after a certain time it can be sold more expensively.

According to Gunvor analysts’ forecasts, such a trend in the market may have serious consequences. According to the results of the last OPEC+ transaction, daily oil production should not exceed 12-13 million barrels. Such values will lead to further supply growth, which is already higher than the demand by 25 million barrels.

Production in countries that have not signed an agreement should also be taken into account. The real output of raw materials could be 15-20 barrels per day. At the same time, the OPEC+ deal participants agreed not to bring 9.7 million to the market. In addition to the agreed figures, the United Arab Emirates, Kuwait and Saudi Arabia will additionally reduce production by 2 million barrels.

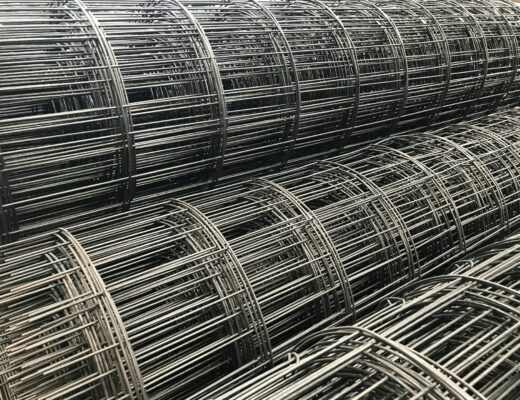

Such volumes of oil need to be stored somewhere, and the number of places intended for this purpose is rapidly decreasing. The overwhelming number of tanks is already occupied, and over time producers and traders will face a shortage of tankers and storage facilities.

The same scenario awaits Russia. Local oil refineries rent tanks from railway logistics companies. The reason for this is technical impossibility to stop the production of raw materials.

The OPEC+ deal was a record-breaking and extremely difficult one. For a long time Mexico did not want to make concessions and cut oil production. However, the countries’ participants managed to come to an agreement, and now the amount of rough in the market will decrease by 19 million barrels in total, which should stabilize the situation and allow the cost to grow.

Saudi Arabia managed to come to an agreement first with Russia, and then with Mexico. The latter did not want to accept new restrictions for a long time, but in the end won favorable conditions for itself. Initially, the country was supposed to reduce production by 400 thousand barrels per day, but other OPEC+ participants made concessions and reduced it by only 100 thousand. The rest was taken over by the US, which together with Canada and Brazil will cut production by 3.7 million barrels.

Despite this, Mexico’s position allowed withdrawing only 9.7 mn barrels from the market instead of 10 as originally planned.