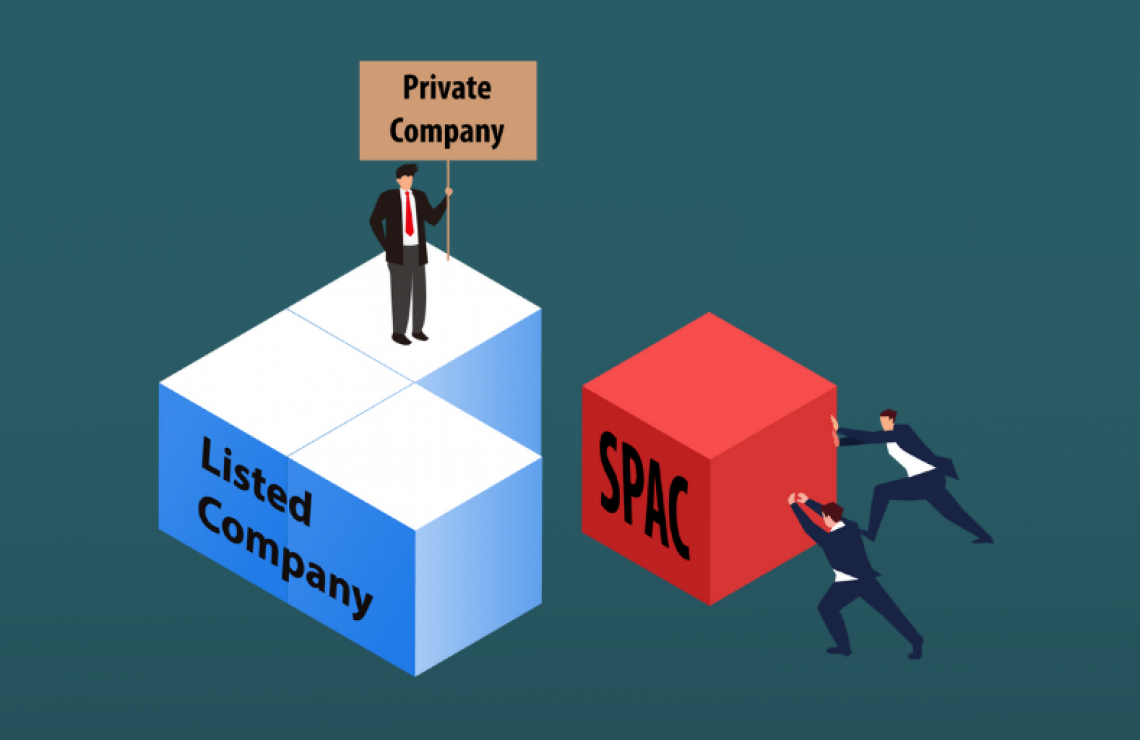

Mechanism for the creation and operation of a special purpose acquisition company

Recently, the use of SPACs to go public has increased. This option eliminates the long and financially expensive IPO procedure. The Special purpose acquisition company itself is not a real firm, but an empty shell, whose function is to carry out mergers and acquisitions in order to enable a business to float on the stock exchange.

Despite the fact that SPACs have been known since the 1990s, they became popular and widely used about four years ago. In 2020 alone, the number of SPACs doubled compared to the previous period, while the proceeds from such offerings tripled. DraftKings, Virgin Galactic, Opendoor and others have recently taken advantage of this market entry option.

The first thing with which this mechanism of placing shares begins – the creation of SPAC, usually engaged in by large investors or well-known personalities. Such a company conducts an IPO, selecting the following features: industry, sector and type of activity, where the funds will be invested in the future. More often than not, when listed, the cost per SPAC share is around $10. The capital raised during the IPO process goes into a trust account, which is similar to an escrow account used to purchase real estate. Further, in order for SPAC to buy a particular company, the consent of all the shareholders of the shell company must be taken.

The capital raised during the IPO process goes into a trust account, which is similar to an escrow account used to purchase real estate. Further, in order for SPAC to buy a particular company, the consent of all the shareholders of the shell company must be taken.

The life span of a SPAC is short, within 2 years. If during this period, the business for takeover will not be selected, the shareholders of SPAC receive the funds invested at the cost of the IPO. In this case, all the costs are covered by the founder of such a company.

In addition to shares, SPACs issue warrants. They are a security that allows you to buy a company’s shares at a fixed cost. This option is an additional motivation to invest in the process of IPO in the void. In addition, the merger process with a real firm can use additional funds through distribution. Such a tool is called a PIPE Raise.

The advantage of a SPAC for its creator is the opportunity to multiply its investment primarily through its prominence and attracting investment for a future merger. In most cases, the founder owns 20% of SPAC shares at their nominal price, and later sells them at market price.

Buyers of securities of such a company can earn a significant amount in the future, which exceeds the income on bonds or deposits. In this case, there are clearly stipulated terms for the return of funds if the SPAC does not find an object to merge.

The benefit to a private company that plans to go public is saving money on the IPO procedure.