Factors influencing the global palladium market

In 2022, the palladium market reached its historic high when the metal cost US$3,002 per ounce. Since then, however, prices have started to fall. Analysts expect this trend to continue into 2025. The main reasons for the predicted decline are oversupply and reduced demand from major consumers.

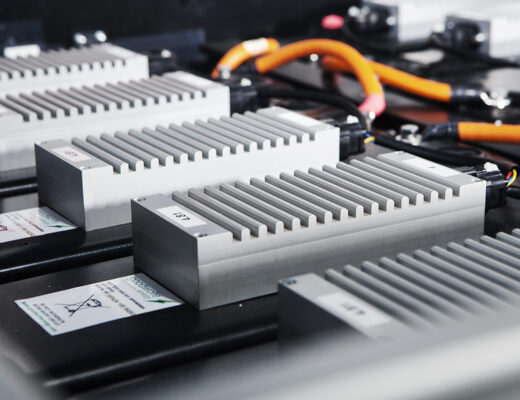

The automotive industry accounts for more than 80% of palladium demand. The metal is used in the production of catalytic converters. But after a record price rise, buyers began to look for alternatives. One of these was platinum, which is priced lower than palladium.

In 2024, bids for the metal ranged from US$900 to US$1,100. In October, the cost reached US$1,200, the result of increased sanctions from the US.

Predictions for 2025

According to Jeffrey Christian of the CPM Group, metal prices will remain in the same range as last year. However, both palladium and platinum could see some depreciation.

The automotive industry will continue to drive demand for palladium. Global car sales should increase by 1.7% to 89.6 million units in 2025, and electric vehicles will account for a significant portion of this growth. However, it is important to note that palladium is not used in the production of battery-powered cars.

Experts do not expect the development of the electric vehicle sector to have a significant impact on the palladium market. According to S&P Global Mobility, the share of electric vehicles in the global car fleet was:

– 7% in 2023;

– 13.2% in 2024;

– and it is expected to be around 16.7% in 2025.

Experts believe that the slowdown in the growth rate of electric vehicles is due to market saturation. The low availability of infrastructure is also a limiting factor in the sector’s development.

On the automotive side, palladium demand will be 8.5 million ounces. This compares with 9 million ounces in the pre-pandemic period. At the same time, the metal market will be in oversupply from 2025. The surplus will be around 897 thousand ounces. The reason for this is the increase in secondary processing. In addition, analysts are forecasting a rise in production from mines in Africa.

Another problem for the auto sector is the new US tariffs. The White House has repeatedly talked about the likelihood of increased tariffs for trading partners.

In general, the cost of the metal will be kept within the US$900-1000 range. Analysts believe that the weakening of the market will continue until 2026.