Webull merges with SK Growth Opportunities

Webull has agreed to a USD 7.3 billion deal with SPAC firm SK Growth Opportunities. The move will allow the brokerage to list on the Nasdaq US stock exchange.

SPAC firms do not conduct business operations. Their purpose is to raise funds for an IPO of a private company as part of a merger. This IPO mechanism is less costly than a traditional listing. After the merger, the SPAC company will be in liquidation. This is exactly the method used by online broker Webull to list its shares on the Nasdaq.

It is worth noting that the company chose the optimal time for the IPO. According to experts, the market is showing activity after two years. Investors are becoming more optimistic and ready to invest in promising projects. In addition, market participants are optimistic about falling interest rates.

According to Webull’s CEO, Anthony Denier, the company has been trying to enter the stock market for a long time. However, the traditional IPO mechanism was fraught with difficulties. As a result, the broker abandoned it and looked for other ways to place shares on the market. The deal with SK Growth was the best way to list relatively quickly and without excessive costs.

Webull business overview

Webull is a holding company incorporated in the Cayman Islands. Its head office is in New York. Through its subsidiaries, the company operates an online e-commerce platform. The latter offers a wide range of services, including trading in:

– shares;

– exchange-traded funds;

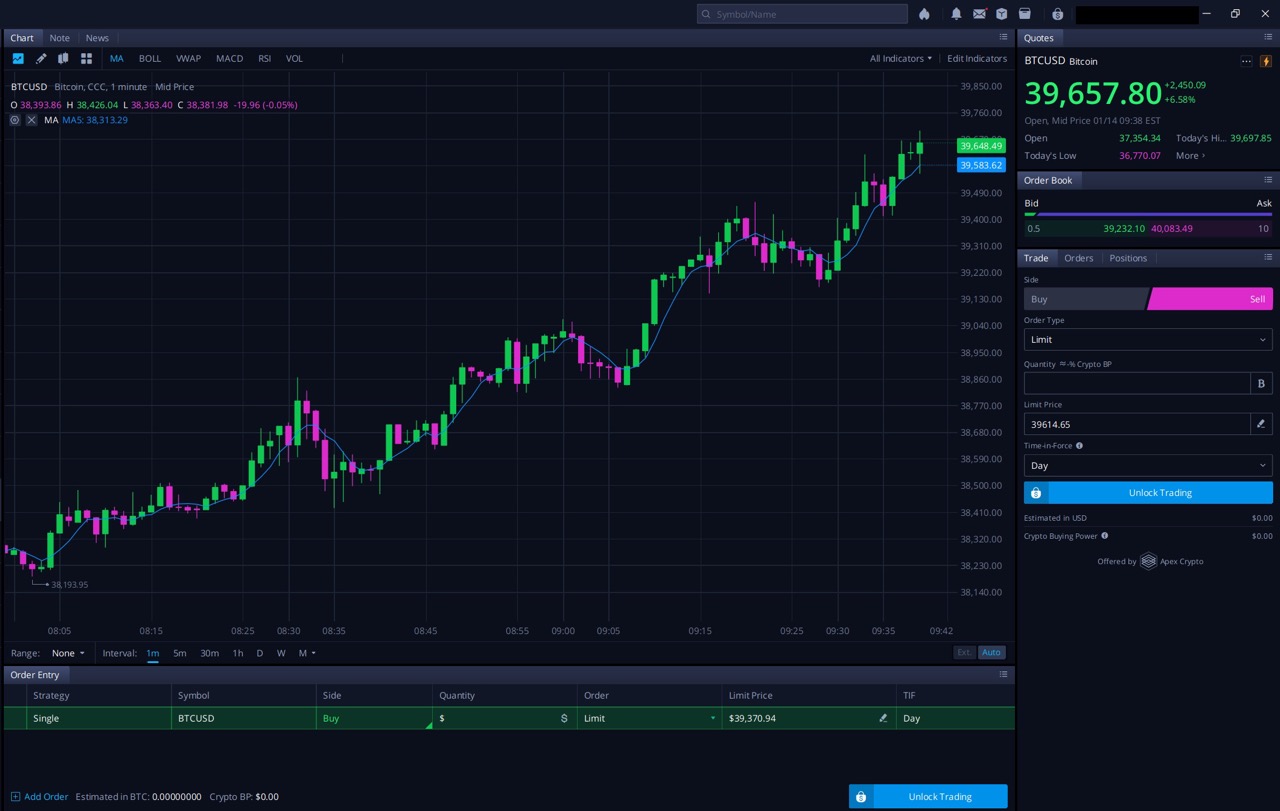

– cryptocurrencies;

– options.

Via a mobile application or a client on a PC, transactions on the platform are commission-free.

Webull Financial, a subsidiary, operates in the United States. It provides services to citizens of the country and has the necessary regulatory approvals. It is also a member of FINRA and SIPC. In addition to the US division, the company operates through subsidiaries in Hong Kong and Singapore.

Wang Anquan, who previously worked at Alibaba, founded the company in 2017. In 2020, Webull received approval from the SEC to launch a virtual assistant for its platform. By the end of this period, the platform introduced the ability to transact in cryptocurrencies.

The company grew rapidly. The online platform traded 430 million options contracts in 2023. The volume of trading operations with shares totalled USD 370 billion. The highest number of users was 952 thousand people per day. This indicator was on record in January 2021. Such activity was connected to the mass purchase of GameStop shares.

Webull’s competitor is Robinhood. However, according to Denier, their clients are more progressive. They actively use analytical tools to improve the efficiency of their trading strategy.