UK economic growth will depend on the successful implementation of reforms

Following Labour’s landslide victory, analysts are predicting UK economic growth. Specialists at Goldman Sachs have revised their expectations upwards.

Other analysts agree with their colleagues. JPMorgan notes that the governing party’s planned activities will provide a strong economic stimulus. We are talking about reforms and revisions of several legal regulations.

In a new publication, Goldman Sachs gives such a forecast for UK GDP:

– the rate will reach 1.6% in 2025;

– GDP will be lower at 1.5% for 2026.

In general, analysts’ expectations rose by 0.1 p.p. Despite the insignificant growth, experts expect a noticeable improvement in the UK economy. The implementation of the new government’s agenda will prove this. It includes:

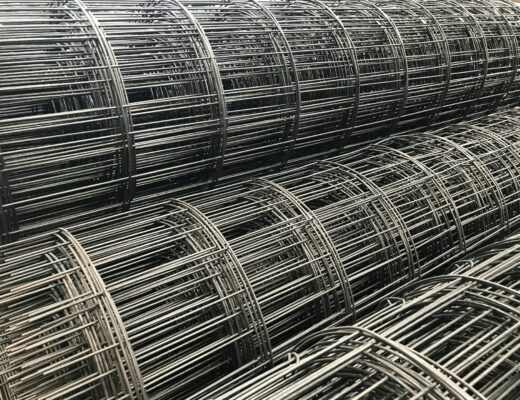

– reforms in the planning system. These should provide an incentive to increase housing construction;

– increasing public investment in the industrial sector;

– strengthening trade links with the EU to offset some of the losses from Brexit.

The systematic implementation of these changes will support the growth of the UK economy.

However, experts have also highlighted the risks associated with the reform. One is the tax increase promised by Labour. This could put pressure on investment inflows. In addition, the government plans to reduce net migration, which poses some risks. The main risk is a reduction in the labour force.

Stock exchange reaction to the party’s victory

The financial world reacted positively to Labour’s election victory:

1. The FTSE 100 index was up 0.29% on the results announcement. It reflected investors’ reaction to the change of government.

2. The FTSE 350 household and building products index rose 3.8%.

Shares in individual companies in the indices also rose:

– Persimmon shares increased by 4.7%;

– Taylor Wimpey shares grew 4.2%;

– Barratt Developments rose 3.5%;

– Bellway shares were up 3.9%.

According to analysts, the most notable improvements are likely to be in the housing sector, where the party’s main efforts are focused. However, JPMorgan cautions against expecting dramatic and rapid changes.

The UK economy has several problems that require a comprehensive solution. The party’s manifesto focused on the acute housing shortage, which is largely due to the bureaucratic difficulties associated with building. At the same time, the authorities need to pay attention to other sectors to maintain their political ratings. Only comprehensive measures will help strengthen an economy recovering from recession.