Steel prices on Chinese exchanges drop to record lows

The other day, steel exchange prices on the Shanghai platform showed a drop. Such dynamics are surprising if we take into account the decline in inventories of raw materials.

However, experts note that the demand for steel in the near future may fall significantly. This is primarily due to a slowdown in the real estate market. Since the beginning of the year, the cost of construction materials rose, forcing many developers to slow down the pace of projects.

The cost of steel has now fallen to its lowest level since the pandemic began in 2020. The situation in the industry is exacerbated by the COVID-19 outbreaks in China and tough measures to address them. As a result, steel prices continue to fall despite the reduction in raw material inventories, which is causing serious concerns for the manufacturing sector.

Global Energy Monitor conducted a study of the global steel industry. According to the results, there is a serious probability that the segment will lose from $345 billion to $518 billion in the next few years. The main reason for asset write-offs is the use of blast furnaces, which are the traditional way to cast steel. However, their use runs counter to the strategy to reduce carbon emissions, which is followed by a large number of countries. Blast furnaces use coal, which is being phased out. If the consumption of this raw material is reduced, blast furnaces will become useless, which will lead to serious losses for the industry. Previously, projections of asset losses were estimated at $70 billion.

Blast furnaces use coal, which is being phased out. If the consumption of this raw material is reduced, blast furnaces will become useless, which will lead to serious losses for the industry. Previously, projections of asset losses were estimated at $70 billion.

First of all, the production facilities that are located in China, India, and other Asian countries are expected to suffer losses. It is in this region that about 80% of new steelmaking facilities are planned to be built. The main raw material for them will be coal. Global Energy Monitor notes that facilities for the production of more than 345 million tons of metal per year are being built or will be built in the near future.

However, such a pace is inconsistent with the achievement of climate goals. Now about 7-9% of total carbon dioxide emissions come from the steel industry.

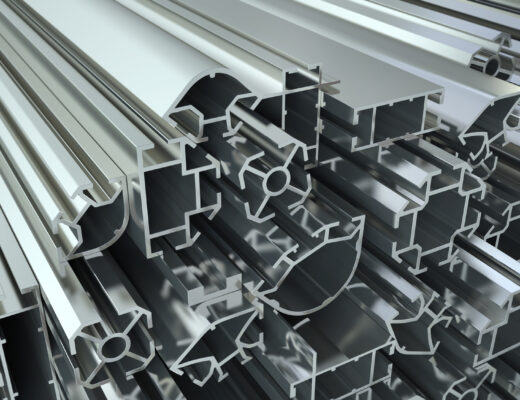

One way to reduce emissions in steel production is to use electric arc furnaces instead of blast furnaces. The first ones are used to melt scrap metal and emit less carbon dioxide than the traditional process. Some companies have already switched to this type of steel production, but it requires large investments to modernize the industry.

In addition, a number of companies are researching and introducing other technologies that will capture carbon so that it is not emitted into the atmosphere. However, such innovations require a lot of money and time to implement, and many companies are not ready to give up blast furnaces.