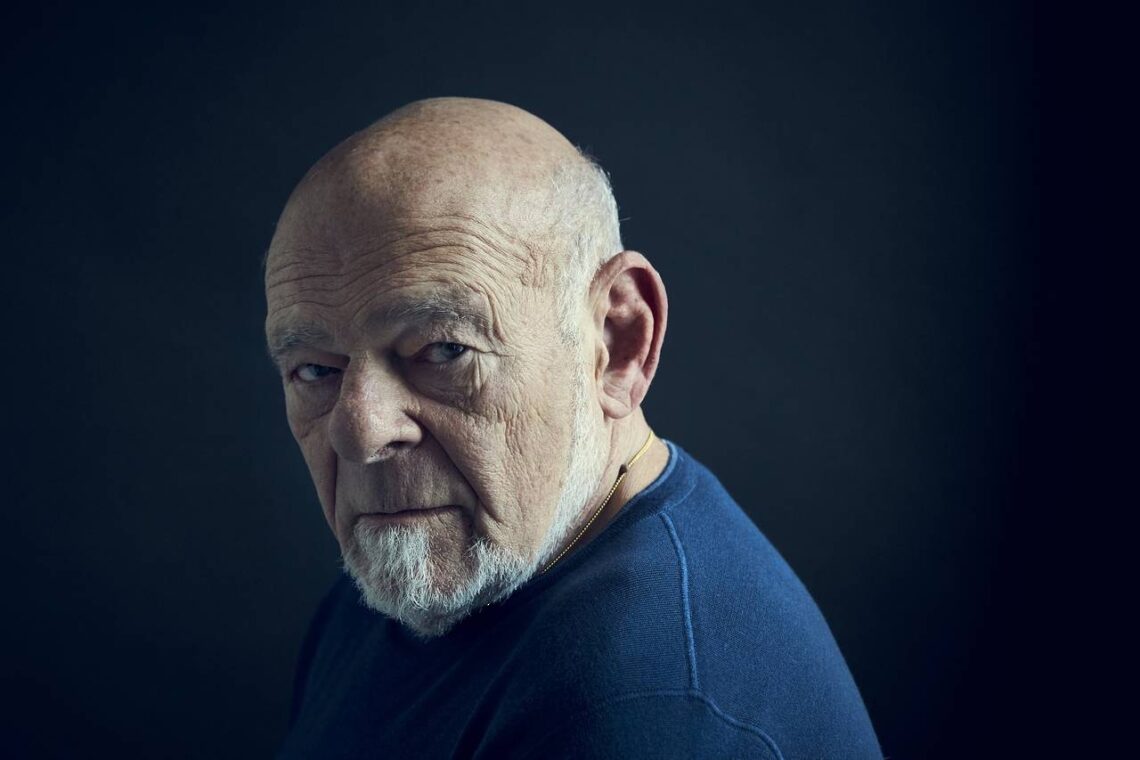

How Sam Zell built his Equity Group Investments empire

Sam Zell was an authority on the real estate investment market. He had an uncanny ability to turn failed projects into great and profitable ones. It was Zell who created real estate REIT funds as we know them today. The investor’s firm manages the largest of the REITs, including EQR, with a capitalisation of over US$23 billion.

Early years

Zell’s parents were Jewish immigrants from Poland who arrived in the United States in 1939. The future investor was born there in 1941. From an early age, the boy showed the makings of a businessman: at the age of 12, he sold Playboy magazines and made a good profit.

After graduating from high school, Sam went to the University of Michigan, where he and his friend Robert Lurie were involved in managing student housing. The young men acted as intermediaries between student tenants and landlords. Gradually, Zell and Lurie began buying old properties at a discount, fixing and renting or selling them. Thus, by the time Sam graduated in 1966, there were already about 4,000 flats under management, among which 100-200 belonged to him. After graduation, however, Sam decided to return to Chicago and sold his share of the business to his partner.

In his hometown, Zell took a job in a law firm, but after only a week, he realised what he really wanted to do. He returned to property investment and, in 1968, founded his own company, Equity Group Investments, which later grew into a large corporation.

Business development

Zell invited his student partner, Lurie, to join the company. It is worth noting that the start of the investors’ activities coincided with a difficult period. The construction boom of the 1960s and 1970s ended with the market crash in 1973. This led to:

– the collapse of the housing sector;

– a fall in demand for office buildings;

– defaults on many commercial property loans;

– a freeze on building projects.

Businessmen took advantage of the situation and bought property at low prices. When the market recovered, Equity Investments had high-quality residential, office, and retail properties under management. Zell and Lurie used rental income to cover the debt of buying the buildings.

It is worth noting that owning a property to rent out was a new approach at the time. Most investors made money by reselling properties.

The business grew rapidly, and in the 1980s, the partners decided to diversify their portfolio. They bought companies on the brink of bankruptcy and rescued them. The structure of the investments included transport companies, packaging and fertiliser manufacturers, industrial and other companies.

In 2007, Zel sold 573 office properties from the Equity Office REIT portfolio. The buyer was Blackstone, and the deal was valued at US$39 billion, making it the largest leveraged buyout. Interestingly, Sam decided to sell these properties just before the 2008 financial crisis, which led to the property market’s collapse.

Sam Zell died in 2023 as a result of complications from an illness.