Richard Dawood Donchian and his contribution to the development of technical analysis

Richard Dawood Donchian has made significant contributions to the creation of indicators and the development of technical analysis. He was one of the first financiers to work with managed futures. The businessman owned a futures fund established in 1949.

Donchian was born in Connecticut in 1905. He got his education at Yale University, where he majored in economics. After graduating in 1928, the young man returned home to run the family business, a carpet distribution company. Richard’s interest in trading came about by chance: he came across a book on the ins and outs of playing the stock market. At the time, the US financial market was facing the crisis of 1929, and Donchian decided to study the workings of the stock market in detail.

Getting started on the stock market

In 1930, Richard took a job with a company that provided asset protection services to traders. This was a young man’s first step into the financial market. After three years, Donchian managed to obtain a position as an analyst in an investment firm, where he gained good experience in studying various instruments and the peculiarities of price formation on the stock exchange.

After the Second World War ended, Richard began working as an investment consultant. At the same time, he dabbled in futures trading.

This activity fascinated the financier so much that in 1949 Donchian organised his Futures Fund to trade in futures. The concept of investment diversification was the basis of the company.

In 1960, in addition to managing the fund, Richard took up the position of Director of Research at Hayden. He remained there until his well-earned retirement.

Research activities

Donchian has earned wide popularity in financial circles and authority among traders with his technical analysis research.

Achievements of the financier:

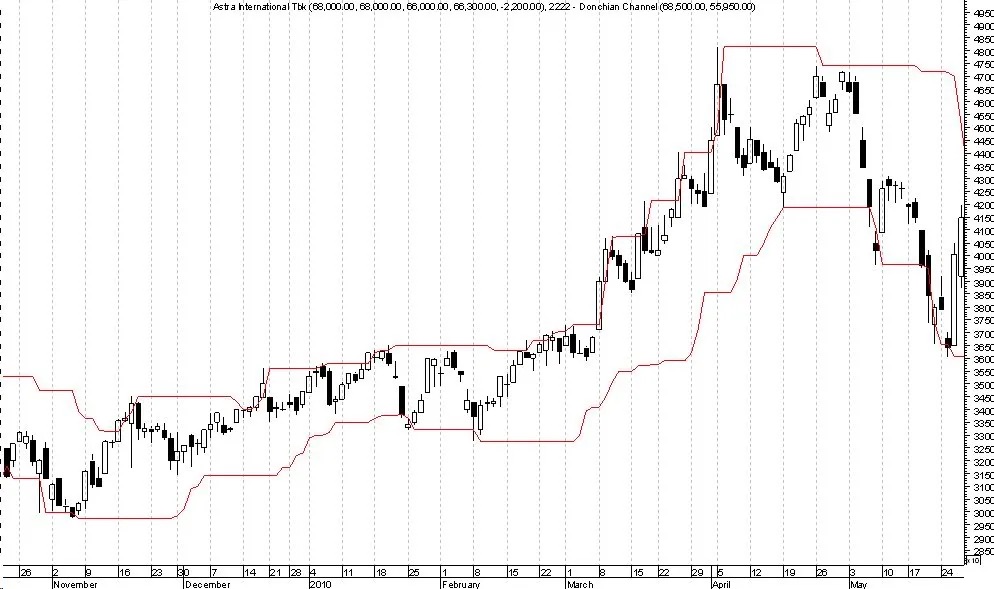

1. Development of the Donchian channel – an indicator that helps to analyse price dynamics and determine support and resistance levels.

2. Study of a dynamic algorithm used for portfolio management. Donchian worked with a strategy that allowed optimal asset allocation to reduce risk and achieve high efficiency of action.

3. There have been a number of investment strategies based on his designs.

Richard has worked as a consultant and educator. He held meetings with traders to discuss the benefits of his strategy and the use of technical analysis. Donchian also ran charitable projects aimed at educating young businessmen. After his death in 1993, a foundation was set up in his honour to help solve children’s health problems.