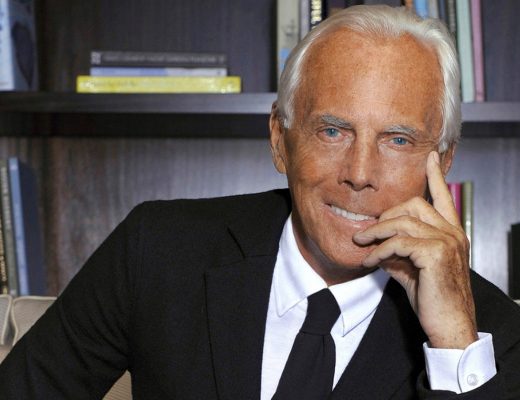

Gina Rinehart: the scandals that led to success

Gina Rinehart is the head of Hancock Prospecting, an iron ore mining company. Gina’s business acumen has enabled her to build a solid industrial empire, and she became Australia’s richest woman in 2020, with a fortune of USD 13.5 billion.

Gina is well-known for her tough management style. Scandals and lawsuits have dogged her career. But that has not stopped her from building a successful business.

The Rise of Gina Rinehart

Gina’s father, Lang Hancock, founded the Hancock Company in 1952. He started with one mine and later opened several more. In 1954 Gina was born. From the age of 10, the girl accompanied her father to the fields, where she learnt the practicalities of ore mining. Gina never went to university. Instead, she preferred to work in the family business. At 19, she married a mine worker and had two children. After eight years of marriage, however, the couple divorced. In 1983, Gina married a 57-year-old lawyer from the US for the second time. She gave birth to twin girls, but the man died seven years later.

Family scandal

All the while, Gina was concentrating on the family business. But the company began to run into difficulties. Hancock remained at the head of the company, but after his wife’s death, he gave up his position. His daughter then hired a maid for him, who later became the businessman’s wife. Hancock’s affair involved a lot of spending, which had a negative effect on the company’s fortunes. Gina was strongly opposed to her father’s behaviour, and after another argument, he removed her from the management of the company. They did not reconcile until 1992, shortly before Hancock’s death. His widow received USD 70 million in his will, even though the company was on the brink of bankruptcy. It took Gina 14 years to contest the will, but she won.

Business under Gina’s management

After her father’s death, she had to take over the company. She focused on increasing production and opening new mines. As a result, Hancock entered the Asian market, and by the end of the 2000s, the company was turning a profit. Gina’s achievements are hard to overstate:

– the company’s equity totalled USD 2 billion in 2010;

– in 2011, rising ore prices doubled the company’s assets – its revenue grew by 2 million per hour;

– by 2012, the women’s personal capital had already reached USD 28 billion.

Gina Rinehart’s management style has often been the subject of criticism. She treats workers as expendable, firing them harshly or cutting their wages. Hancock’s ore production raises many questions for environmentalists. But Gina pays no attention to such organisations, only to the company’s prosperity.