VWAP indicator: an overview of the use of weighted average price

The VWAP indicator is one of the varieties of moving averages. It is also called a weighted average price. It is designed to fix trading volumes when averaging the price. Moreover, it takes into account the trading volume on each value of timeframe: the higher the value, the greater will be the weight of the price in a particular timeframe.

In order to get the VWAP value, you need to take the total trade value for each transaction and divide it by the total volume. The trade value is the result of multiplying the price by the volume.

The indicator is calculated within a specified period, and it can be for different timeframes. VWAP takes into account the information from the beginning of the specified period to the end in the accumulation mode, and the data cannot be averaged. The necessary time limits are set in the settings: you can take as a basis the time zone, on which the broker works. The results are marked by a line on the chart.

It should be understood that VWAP does not show large positions on one side or the other. The purpose of the indicator is to inform about the price value at different volume levels, which serves as a sign of liquidity, both its high value and low. The main difference between VWAP and classic moving averages is the data to be calculated. While in the moving averages, the price comes to the terminal from reputable banks or brokerage companies, in VWAP the platform takes data on volumes from the Globex system, provided by Chicago Mercantile Exchange. This feature makes use of the indicator paid.

The main difference between VWAP and classic moving averages is the data to be calculated. While in the moving averages, the price comes to the terminal from reputable banks or brokerage companies, in VWAP the platform takes data on volumes from the Globex system, provided by Chicago Mercantile Exchange. This feature makes use of the indicator paid.

There is also a free version, but it takes the tick information from one or another broker for VWAP. Since this data is different for each broker, the result can be unreliable.

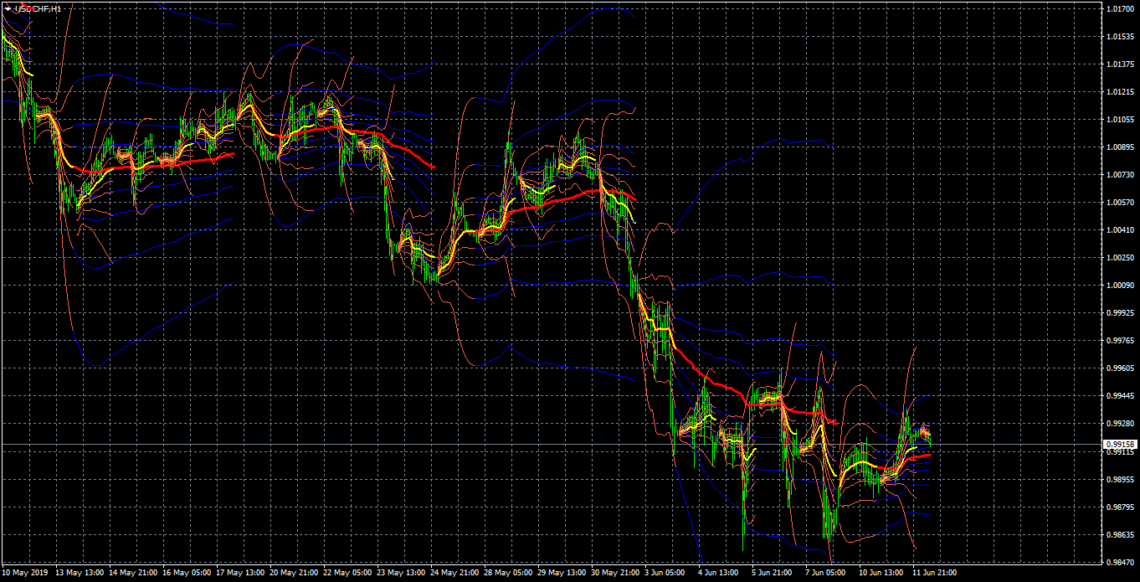

Due to the fact that VWAP is paid, novice traders prefer to use sliders. However, experienced players prefer VWAP because of its advantages. The latter build different trading strategies based on the indicator and their choice depends on the indicator version. For example, the version for MT5 has almost a complete set of tools, which is great for the channel approach. As for MT4 – this is a simplified version that allows working with VWAP as with moving averages. For example, take two indicators with different periods.

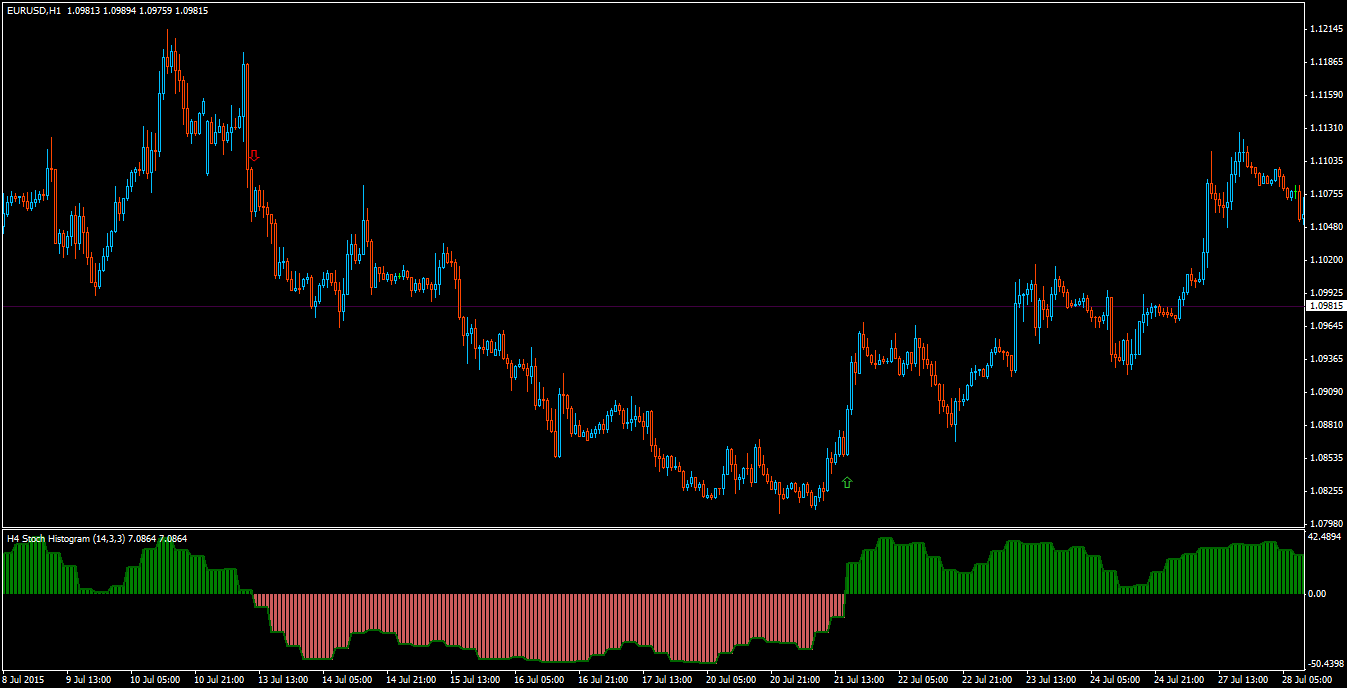

There is also the concept of price action, where you need to find patterns with five or more candles. Here it is necessary to create support and resistance levels, as well as Fibonacci corrections. In addition to the numbers, it is necessary to find breakpoints. It should be taken into account that the latter can be a correction – it will work as a signal from the VWAP.