How you can use a straddle to profit in the market

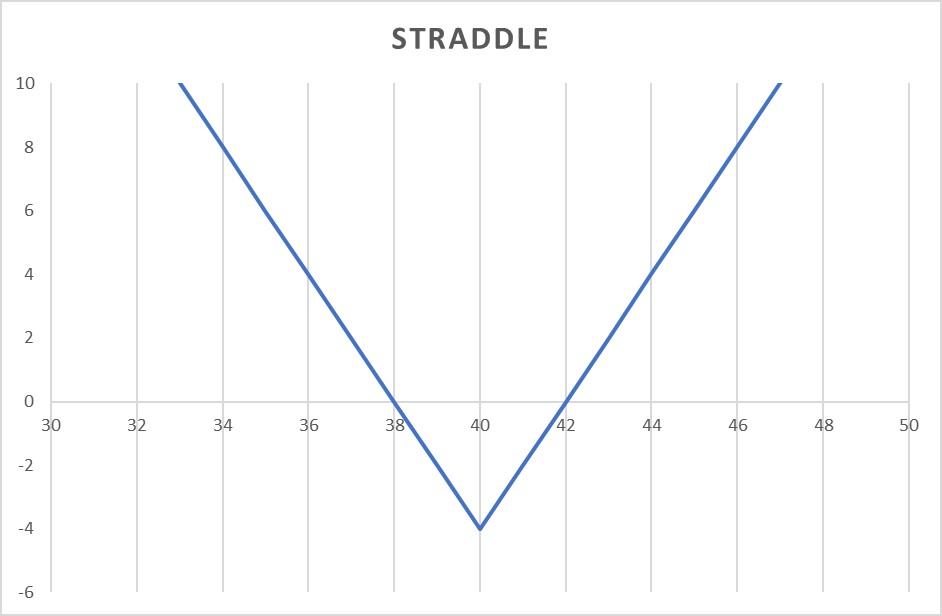

One of the option strategies for making money on the exchange is to use the price movement of the underlying asset without reference to direction. An example of such an approach is a straddle, which includes call and put options purchased at a central strike. The strategy works as a bundle of all components, but has its own peculiarities which should be taken into account when applying the approach in a trader’s activity.

In most cases, the central strike is characterized by the highest level of liquidity, so it is possible to acquire calls and puts without much effort. The total delta of these options is approximately zero, making the straddle itself a delta-neutral strategy. If the market rises, the value of the call rises and the value of the put falls. If the futures are declining, then the put price goes up and the call price goes down. In this case, the trader gets the money regardless of the direction in which the market changes, the main thing here is its movement by the value, which is similar to the value of both options. When the market dynamics continues, the call or put, depending on whether the decrease or increase is recorded, compensates for the cost of buying options. Such an option means that the player will profit by exercising the option that went out to the money. The trader can also sell the result by taking advantage of the increase in its value.

The risk in this case is in the stability of the futures when it is in one place. Then the options gradually decrease in value due to temporary decay, which leads to a decrease in volatility. There is a possibility of losing the value of both the call and the pool. There is an option to hold the construction until the expiration date. In this case, the market movement should be at least the sum of the value of the options, regardless of the direction. If the dynamics continue, then the trader makes a profit. But this option is rarely used, since most players are focused not on building the structure and waiting for the expiration, but on selling the straddle at the maximum cost during the market movement.

There is an option to hold the construction until the expiration date. In this case, the market movement should be at least the sum of the value of the options, regardless of the direction. If the dynamics continue, then the trader makes a profit. But this option is rarely used, since most players are focused not on building the structure and waiting for the expiration, but on selling the straddle at the maximum cost during the market movement.

An important point is to analyze the dynamics of the straddle during a price jump in the futures. For this purpose, the charts of the call and put values and the futures themselves are studied using the QUIK trading terminal.

It is also worth considering the liquidity of the options. In most cases, at the central strike, their spreads average 50-100 pips. When the strike fluctuates by several steps, the spread has a chance to reach 200-300 pips. Such a figure may decrease the expected profit. At the same time, the trader can perform a number of actions with limit orders in the options stack, which, with the right approach, will give a positive result.