How a soft market can increase capital or cause bankruptcy

A soft market is a type of market where there are fewer buyers than sellers. Thus, there is an oversupply in the sector, which leads to a drop in prices. Sellers are trying their best to attract as many buyers as possible and are willing to reduce the cost of supply to do so.

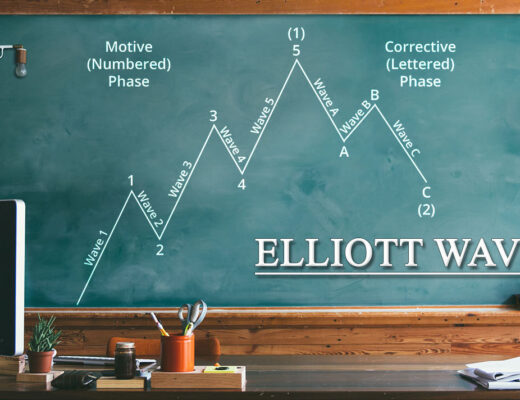

It should be noted that the market by its nature is cyclical, accordingly, a soft market periodically occurs in one or another sector.

Such a phenomenon has a significant impact on both a particular product and the industry as a whole. For example, at some point in time, the real estate market can turn soft, just like any other market. This phase can be quite difficult for sellers with a lot of capital, but due to the availability of funds will not cause serious losses. For those who do not have a lot of money, a soft market can lead to bankruptcy, because during this period these sellers have almost no opportunity to sell their goods. Let’s take the real estate market as an example again. When various factors combine, the segment becomes oversaturated with supply, while the demand for objects decreases. In this case, instead of withdrawing the objects from sale and waiting for such a stage, sellers reduce the price. Their example is followed by others – and a domino effect occurs. This situation plays into the hands of buyers who are trying to get as many deals as possible, moving from one seller to another.

Let’s take the real estate market as an example again. When various factors combine, the segment becomes oversaturated with supply, while the demand for objects decreases. In this case, instead of withdrawing the objects from sale and waiting for such a stage, sellers reduce the price. Their example is followed by others – and a domino effect occurs. This situation plays into the hands of buyers who are trying to get as many deals as possible, moving from one seller to another.

The soft market is often called a buyer’s market, which indicates the domination of the latter. Sellers who need to sell real estate faster find themselves completely dependent on consumers and go for deals that are disadvantageous to them. This period of market development is a great time to invest in real estate in order to get income later. However, in this case, it is important to understand that the duration of a soft market is difficult to predict, followed by a long recovery.

If a soft market has already occurred, it is important to act wisely and remain calm. In a panic, an investor may start to sell assets, which, after a period of time, will prove to be an extremely unprofitable decision. The best option, in this case, would be to hold investments, if the financial condition allows it. The rapid sale of assets can turn into a major loss. In addition, you must take care of capital preservation and diversify the portfolio. For example, keep a portion of your funds in a liquid form, which will support you during a soft market. As for buyers, if they are willing to consider income when investing over the long term, then assets can be purchased.