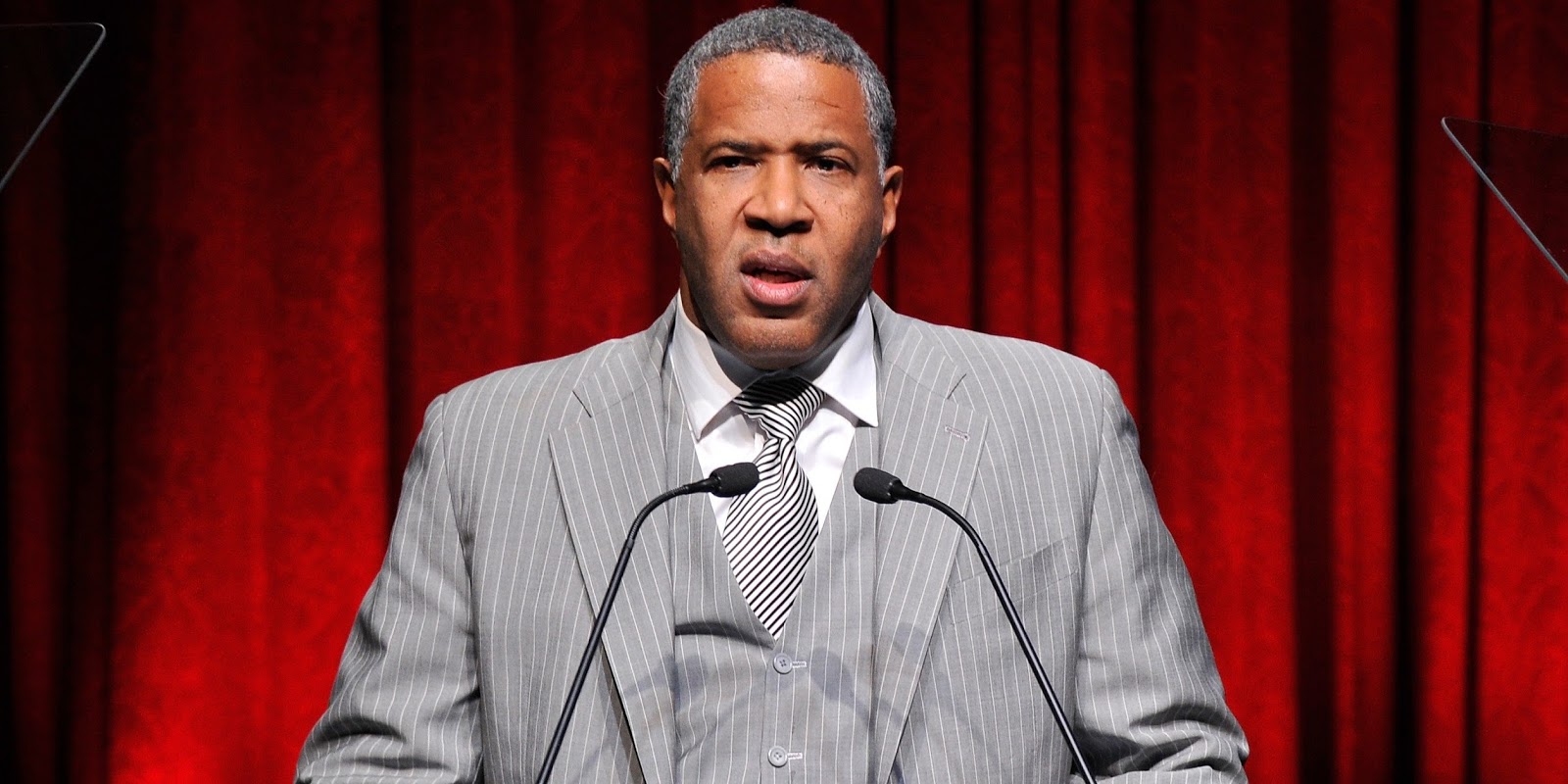

How Robert Frederick Smith made his way to success

Robert Frederick Smith is an American businessman, founder of the investment firm Vista Equity Partners, and philanthropist. He funds various social projects aimed at improving the quality of life and education.

He was born in Denver in 1962. His parents, blue-collar workers, were always active in the community. For example, Robert’s mother sent US$25 a month to the United Negro College Fund. The amount remained the same despite the family’s financial difficulties. The principles instilled in him by his parents played a significant role in shaping the future businessman’s outlook. Robert believes that everyone can contribute to making the world a better place. The investor himself is actively involved in charitable activities.

In high school, Smith developed an interest in technology and engineering. Wanting to create in this direction, the young man applied for an internship at Bell Labs. The company turned Robert down because it only hired college graduates. However, this did not deter the future businessman, and he called Bell Labs every week for 5 months. Finally, his persistence paid off, and Bell Labs invited him to an internship. Smith worked there during the summer and winter holidays, combining the internship with his studies at Cornell University. He graduated with a degree in chemical engineering.

After graduation, Smith worked as an engineer for several companies, including Kraft General Foods.

Investment activities

Smith decided to change direction and try his hand in a new field. To that end, he earned a Master of Business Administration degree from Columbia Business School. Further, Robert’s career developed in several key directions:

– in 1994, he helped found the investment banking division of Goldman Sachs;

– later, he held a senior management position in Enterprise Systems and Storage;

– was directly involved in assisting IT companies with mergers and acquisitions;

– was the first person at Goldman Sachs to focus exclusively on this area of finance.

In 2000, Robert founded his investment firm, Vista. It has over US$100 billion under management. Vista focuses on investing in technology companies, particularly enterprise software developers. The firm uses four financing strategies:

– private equity;

– permanent equity;

– loan;

– public equity.

Today, Smith is CEO of Vista and oversees all business operations. He pays particular attention to investor relations and guarantees a personal approach. Smith’s high profile builds shareholder confidence in the company.