How to fill in the investment declaration and its functions

The standard procedure for concluding an agreement on pension and investment contributions is the issuance of a declaration. Its preparation is also part of the terms and conditions of cooperation with a number of banks, primarily those with pension insurance programs. It can be difficult for depositors to fill in the investment declaration.

This document contains information about the assets in which the funds are invested. The declaration not only explains to the investor all the details of cooperation with a financial institution, but is also important for accounting and management accounting.

Preparation of the investment declaration is the responsibility of the financial department of the bank or fund. It must contain detailed and clear information about the terms and conditions of the deposit, as well as tell the person about the activities of the organization itself.

The investment declaration is used for financial reporting and shows the distribution of funds, income from them. With its help, three important issues can be solved:

- keeping customers informed about the performance and reliability of the bank or fund;

- explanation of capital and profitability mechanisms;

- highlights possible risks that could affect the profitability of the deposit..

The client who concludes a contract with the fund or bank should pay attention to the presence of this paper.

The investment declaration is essentially similar to a business plan. Both of these documents contain information about the institution with which the depositor intends to cooperate. In order to use the declaration as a basis for planning actions, it is necessary to supplement the document with various charts and graphs for the available analysis of the data provided. This will also show the prospects of the fund or bank and its reliability.

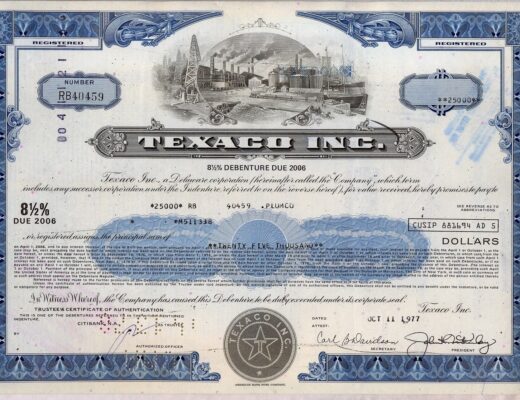

The document is also used as an option for presenting financial statements. In this case, it must be drawn up according to certain rules. First of all, it is necessary to specify the amount of capital that came from the client, the number of shares, the current value of assets.

According to the law, the investment declaration must have the main points:

- Review of the fund, its purpose. It indicates how the assets will be spent as well as explanations of capital growth.

- The list of objects to be invested is the list of companies that are bought by the fund.

- Features of the investment portfolio. The document contains a list of risky securities to be dealt with.

The structure and type of investment declaration is approved by the legislative bodies. At the same time, private funds should follow the rules recommended by the government, but may supplement the paper with their clauses.

It is not only the funds and banks that use the declaration. The document is also made up by companies that issue shares and bonds or those that have received capital for business development as a contribution.