Wyckoff Methods: trends in market development

Despite sharp jumps and grand collapses, all processes in the market have their own pattern. It was described in the early 20th century, and this mechanism is still relevant today. Many traders use Wyckoff methods to understand how the market will behave at this or that moment.

The methods are named after their author – Richard Wyckoff, who after a long work on the stock exchange wrote a textbook on trading on the market, and showed his way of analyzing the situation. His theory was based on three indicators: the volume of a deal, as well as the cost of opening and closing it.

In the 30s, Wyckoff’s method was considered revolutionary. Richard made predictions about what would happen on the stock exchange, and they were a huge success with traders. The basis of his concept was the balance theory. It means that the market always wants to achieve a balance of supply and demand. If there is a bias in one direction or the other, then quotes will fall or rise in order to level the proportion. These fluctuations in turn create different trends, which will depend on what is now prevailing in the market.

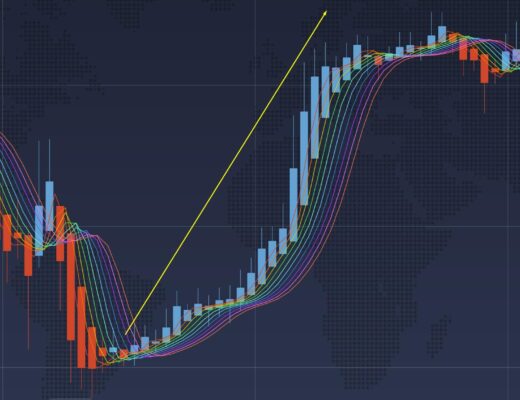

Wyckoff has identified three trends – upward, downward and horizontal or lateral. The first one is created when the bulls have taken stable positions, and supply is inferior to demand. The upward trend is traced by a number of signs, for example, each minimum will be higher than the previous one, and each maximum is higher than the previous one.

A drop in value is considered when a strong bearish market and demand is lower than supply from sellers. A downward trend is seen when the lows with each new case are smaller, as well as each high that is lower than the previous one.

In the case of a horizontal trend, there are no sharp movements and the price does not exceed either the upper or lower limits. The highs and lows are located in almost the same area. These periods are called accumulation and distribution zones, and are recorded after strong trends when the market completes large transactions. At the moment, you should not make abrupt attempts to break out, but wait for the activation of volume. If the latter starts to grow, it means that the trend has increased.

The accumulation zone comes after the price corridor is formed, when the downtrend is over. At this time, traders close the position and keep the value at a certain level. Its decline is almost impossible due to high demand.

When the growth is over, the supply zone begins. Positions are fixed in this case, and there is a large volume of assets for sale.