Types of derivatives and their advantages for the trader

A derivative is a contract that can be concluded with two or more parties. The subject of the transaction is any underlying asset, including bonds, shares, market indexes and others. There are several types of derivatives used on major exchanges and on the over-the-counter (OTC) market.

Over-the-counter contracts are not subject to legislation, which makes them much riskier than exchange-traded contracts, which are standardized.

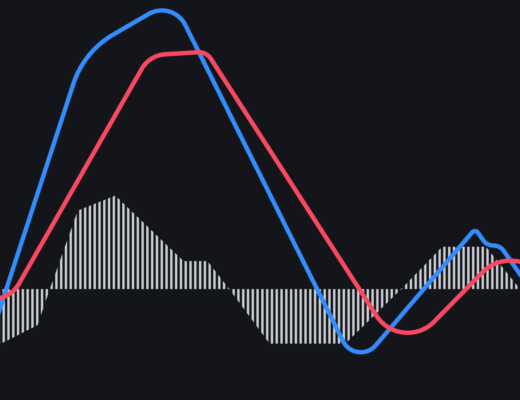

The types of derivatives include futures contracts, which are a popular financial instrument. In this case, the contract to sell the asset will have an agreed value. This option is mostly used for hedging the risks for a certain period of time. When purchasing a futures contract, the buyer is insured against price decrease – during a certain period it will not change.

The second type of derivatives are forward contracts. They are similar to futures, but are only traded over-the-counter. Swaps are also derivatives, and are often used for market activities. They are bilateral contracts that are concluded for the exchange of assets that are traded over-the-counter and have no special conditions. The purpose of using them is to optimize capital and find a source of additional income. Swap allows you to replace one type of cash flow with another, which will have different characteristics. There are debt swaps, currency swaps, and interest rate swaps. One of the popular tools among traders are options. Like a futures contract, such a contract is concluded by two parties, one of which can now buy and the other can sell the asset at a previously agreed value. The difference between options contracts and futures contracts is that after the expiration of the contract the buyer does not have to make a purchase. Such a contract is not considered binding. Options are also used for reducing the risks that may arise if the position does not develop as well as the trader expected.

One of the popular tools among traders are options. Like a futures contract, such a contract is concluded by two parties, one of which can now buy and the other can sell the asset at a previously agreed value. The difference between options contracts and futures contracts is that after the expiration of the contract the buyer does not have to make a purchase. Such a contract is not considered binding. Options are also used for reducing the risks that may arise if the position does not develop as well as the trader expected.

Speaking of derivatives, we should mention secondary financial documents. This includes a huge number of securities, and their application depends on one or another type of derivatives. However, in this case, we should be careful – all risks and liabilities connected with the contract should be assessed.

Derivatives are convenient and popular instruments, but their application will be expedient only if the trader is fully aware of their possible influence on the profitability of the portfolio. Therefore, derivatives are most frequently used by experienced market players who have worked with a variety of instruments and know their intricacies. They allow minimizing risks and increase portfolio returns without extra expenses.