What the derivatives market is: types of contracts

The derivatives market is a system of trading contracts. Their value comes from the price of underlying assets like stocks, currencies, digital assets and commodities. This approach reduces risk and fixes the price at a favourable level.

The market offers different types of derivatives. The most popular among them are:

1. Futures. Contracts that oblige the parties to enter into a transaction at a predetermined price in the future.

2. Options. Instruments that give the right to buy or sell an asset at a fixed price. However, there is no obligation to perform the contract. There are call options and put options. The former gives the right to buy, and the latter provides the right to sell.

3. Swaps. Agreements between parties to exchange payments or assets for a specified period. This instrument provides flexibility in the face of market fluctuations.

4. Contracts for Difference (CFDs). Contracts to pay the difference between the value of an asset at the time of the transaction and its future price. For example, if the price rises, the market participant receives the difference from the original value.

Each type of derivative has advantages and disadvantages. However, if used correctly, derivatives can profit from both the rise and fall in the underlying asset value.

Advantages and disadvantages of the market

Many market participants use derivatives as one of their main tools. These contracts can protect capital against price fluctuations, particularly for volatile assets such as energy sources.

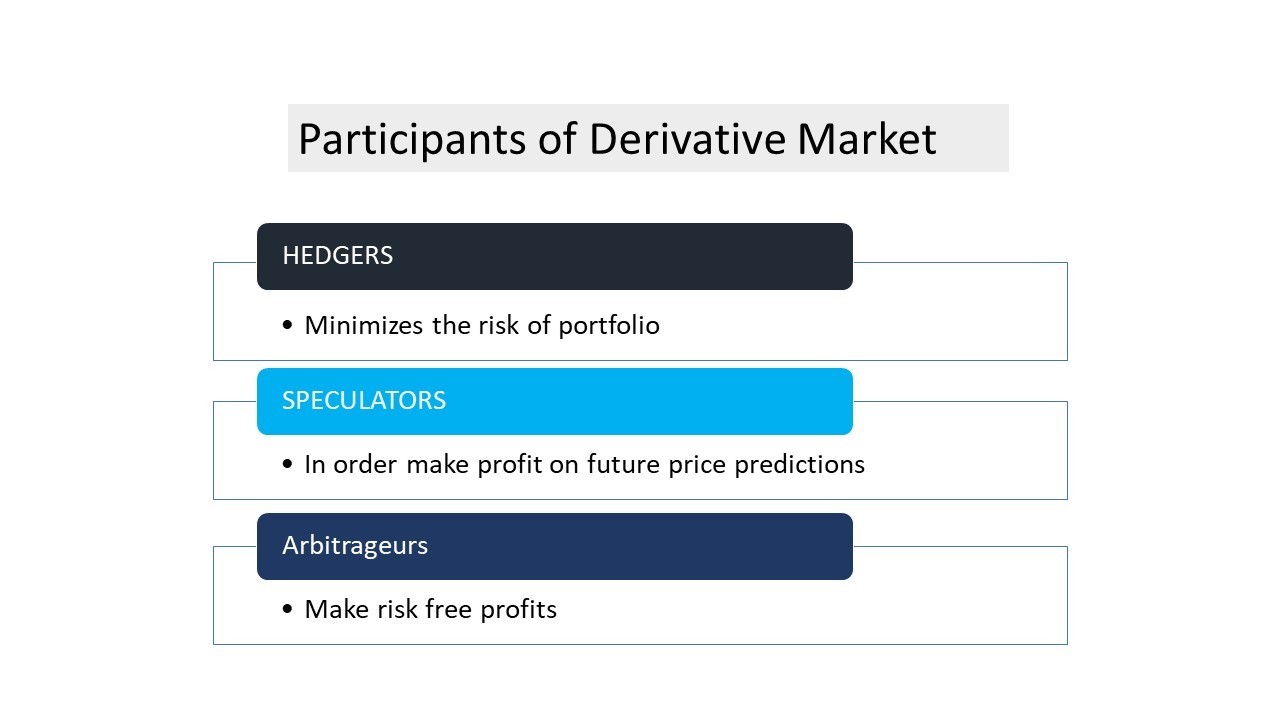

In addition, speculation is not out of the question in the market. They offer the possibility of high profits. However, they also involve high risks.

Derivatives attract players because they offer the possibility of arbitrage, a way to profit from price differences. In this case, it is necessary to react quickly to changes in value.

Transactions are often made using leverage, which permits transactions for amounts exceeding the trader’s available capital. This approach offers significant potential for profit but also increases risk.

Despite the derivatives market’s attractiveness, it is crucial to be aware of its characteristics. High volatility and unpredictable price dynamics, influenced by external factors, make trading difficult even for experienced traders and analysts. Sudden changes in the market can lead to significant losses.

To work successfully with derivatives, it is necessary to:

– study their mechanism thoroughly;

– take into account possible risks;

– to think over the trading strategy;

– avoid exceeding the acceptable level of risk.

In general, the derivatives market offers great opportunities to earn money but requires a balanced approach and competent capital management. Market participants must constantly monitor changes in market conditions, be prepared for possible risks, and consider psychological aspects of trading.