Thomas Bailey: how the business developed after his departure

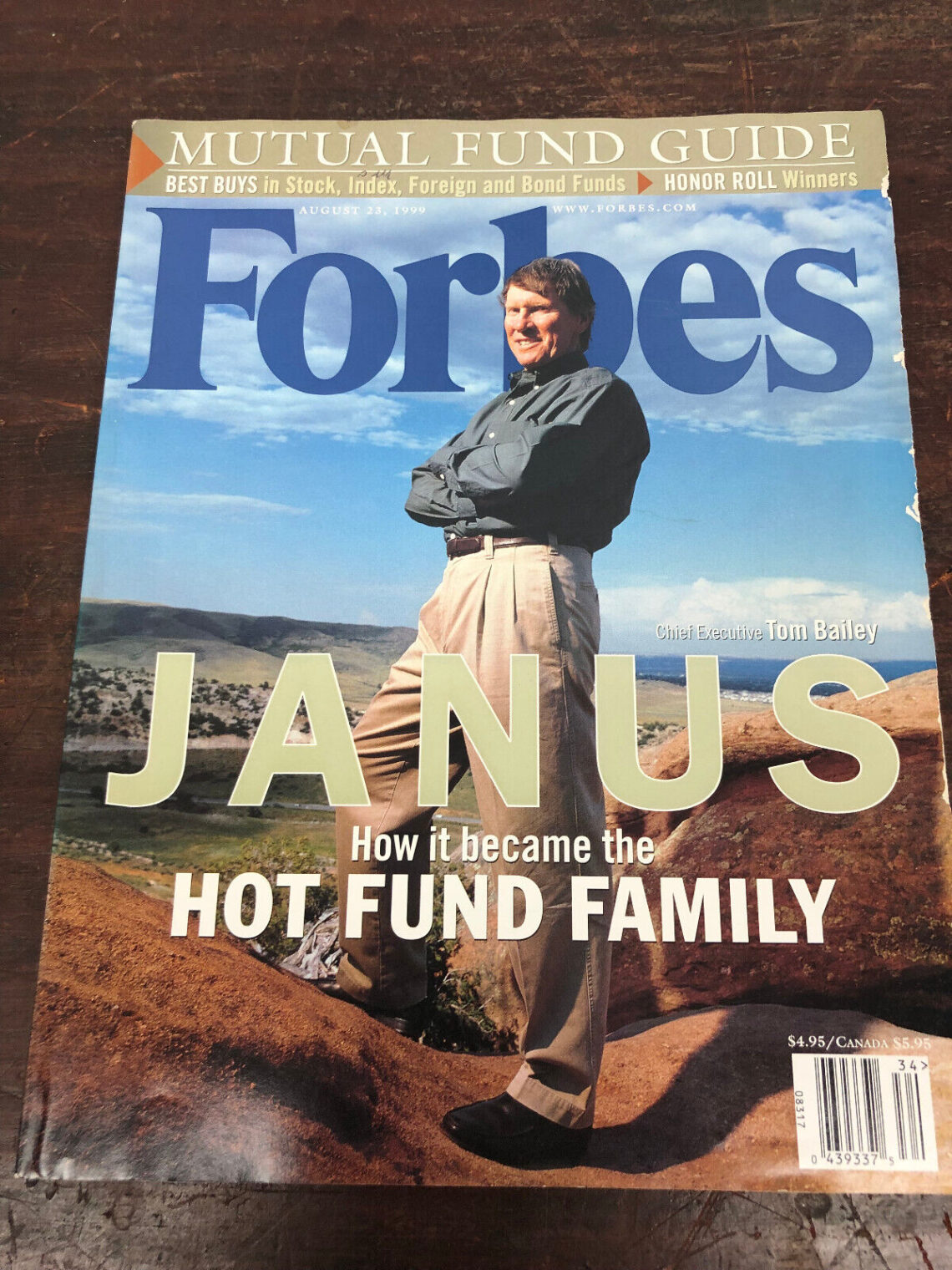

American businessman Thomas Bailey is a founder of Janus Capital, one of the country’s most significant mutual funds. The businessman has significantly contributed to developing the mutual fund industry and is highly respected in business circles.

Bailey was born in the United States in 1937. He holds a bachelor’s degree from the University of Michigan. Thomas studied science and art but never pursued them in his life. Instead, the future billionaire became interested in business and later earned an MBA from the University of Ontario.

Developing his own business

Thomas did not come to finance traditionally. He was a fisherman and raised horses until he became interested in stock trading. After trying his hand on Wall Street, Bailey set up his own business in Denver in 1969. It was a mutual fund called Janus Capital Group. The company started with a few hundred thousand dollars in assets, and by 2008, it had grown to around US$188 billion. The company grew aggressively and went through several transformations in the 1980s:

– Kansas City Southern Industries became interested in the fund in 1984 and bought a controlling interest;

– Janus launched two new funds in 1985, including a small-cap unit;

– the first global fund appeared in 1991. The company also launched a range of financial products for investors;

– as the company grew, it spun off its financial division into a separate company, Stilwell Financial, in 1999.

Bailey remained at the fund’s helm but decided to step down in 2002. He sold his 12% stake to Stilwell. The transaction was worth US$1.2 billion. The financier managed to build a strong business that continued to develop despite the change in leadership.

The business without Bailey

Janus Funds offered investors a wide range of instruments and flexible terms of cooperation. These included the ability to invest in pension plans and variable insurance contracts.

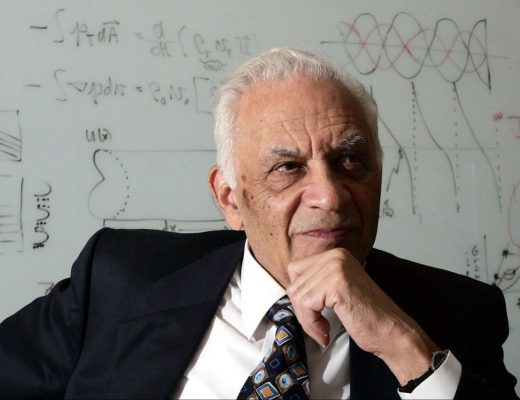

One of the fund’s key success strategies was building a solid team of professionals. Bailey instilled this principle, which has remained essential to effective operations since his departure. In 2014, for example, two major figures in the financial world joined the team:

1. Myron Scholes took on the role of chief strategist in the investment division. He is a Nobel laureate and a Ph.

2. Bill Gross joined from Pimco. At Janus, he became the global strategy manager for the unconstrained bond sector.

The 2000s were a difficult time for the fund. It lost several investors but managed to recover. Today, Janus continues to run a successful business, having merged with Henderson in 2016.