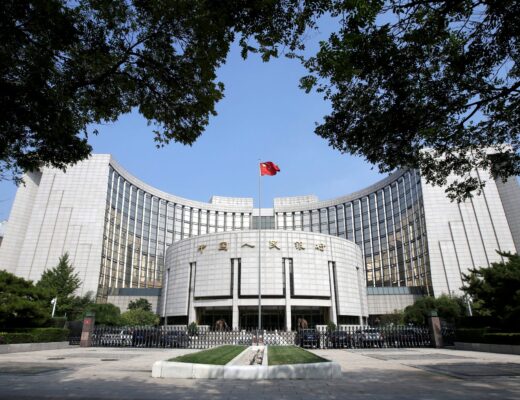

China’s lending rate has not been revised yet

China is stagnating due to the pandemic and the property crisis. The government has taken various measures to stimulate the economy, and they seem to be working. As the market has recovered, China’s lending rate has remained unchanged so far.

In July, the country’s central bank lowered lending rates to a record low, surprising experts. According to analysts, the move was premature, as the market was not ready. In addition, the bank was trying to mitigate the consequences of the rally in the bond sector at the time. Along with interest rates, the regulator reduced the size of the seven-day repo by 0.1% to 1.7%.

In the following review, the Bank decided to leave the one-year and five-year rates unchanged in view of the positive developments. The current one-year LPR is 3.35%, while the five-year LPR is 3.85%.

Reasons for the decision

The one-year rate is the country’s base rate for loans to businesses and households. The five-year rate is used for mortgage loans. It is worth noting that both rates are seen in China as a way of regulating the economy and consumer spending.

Chinese central bank has a difficult task ahead of it. It needs to provide vital support to the economy. At the same time, it needs to reduce the risk of the market overheating. It is also under pressure from the government’s targets. According to these, the growth target for 2024 should be 5%, which is extremely difficult in the current environment. According to experts, the seven-day repo rate can play the role of the central bank’s policy rate in managing the market. It could become an alternative to the MLF’s medium-term lending rate, which has been used for this purpose for two years.

July rate cut led to a sharp fall in government bond yields. In addition to rate revisions, a surge in speculative trading also contributed to this result.

Signs of recovery

China’s government is providing substantial support for the growth of the local economy. However, some of the measures are drastic and do not always have the expected results. That is why the central bank is advising the authorities to avoid rash steps that could lead to fluctuations in the already fragile market processes.

As for the news on the economic recovery, they are all ambiguous. The situation is as follows:

– the country’s GDP grew by 4.7% in the second quarter;

– this was lower than the expected 5.1%;

– the first quarter showed a result of 5.3%.

According to official statistics, the third quarter was more successful for the Chinese economy. It showed growth, albeit modest compared with the pace of the pre-recession. The following results evidence this:

1. Retail sales rose 2.7% in July, up from 2% in June.

2. Industrial production rose by 5.1%. This was the slowest pace in four months.

3. Exports rose by 7% and imports by 7.2%.

The economic recovery is not as fast as the government had planned. However, progress is being made, which may encourage the central bank to cut interest rates.