Brady Bonds: types and features of securities

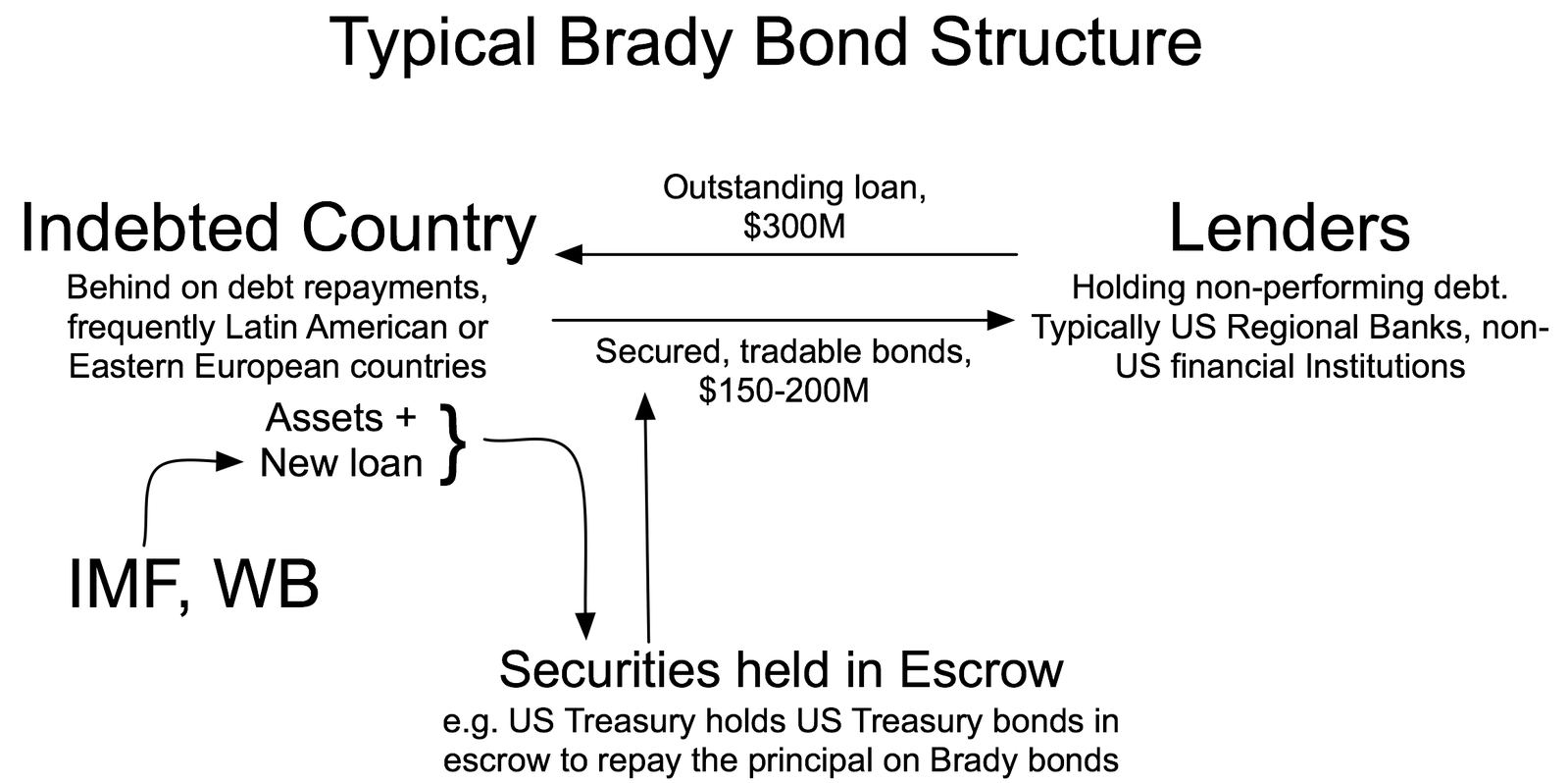

Brady Bonds are securities issued by emerging market governments. They are considered one of the most liquid financial instruments of this type for emerging markets. Bonds get their name in honor of Nicholas Brady, who served as U.S. Treasury Secretary from 1988 to 1993. One of the directions of his activity was restructuring debt obligations for developing countries. Thus, the Brady plan was developed, which included the issue of special government bonds. The IMF and the World Bank were partners in the realization of the project.

The practice of such securities began in 1989. At that time, a large number of Latin American countries were forced to default because they could not pay their debt obligations.

Bonds of this type are in most cases denominated in dollars, most often used in Latin American countries. However, there were practices when the value of securities was in the national currency of Switzerland – francs, and of Germany – marks. The main purpose of the issue – is the transfer of a debt in securities, which are secured by the U.S. Treasury, in the form of zero-coupon securities, valid for 30 years. In addition, creditors can choose several bond options, so the investor can choose the best solution for him or her to get a return. For debtor states, there was an option to defer payment until there was tangible growth in the local economy.

Bonds are of two types:

1. Bonds that are sold at face value. They are offered at a price similar to a loan on the original terms but have a lower coupon rate. Guarantees remain on all types of payments.

2. Bonds that are sold at less than their face value. They have a discount on the original loan price, and guarantees apply to principal and interest payments. The value of the coupon is similar to that accepted in the market.

Experts are generally positive about the introduction of Brady bonds. However, there have been failures in their use, such as the default in Ecuador.

In 2003, Mexico managed to offset its debt obligations using this mechanism. It was the first country to overcome the crisis thanks to the Brady Plan. After Mexico, the Philippines, Brazil, and Venezuela showed the same result.

One of the advantages of bonds is their long maturity period, which increases investors’ interest in the securities. In addition, the yield here is quite high due to a fairly narrow spread.

The issuance of these securities implies that debtor countries should introduce a number of reforms aimed at improving trade investment processes, as well as strengthening the macroeconomy. Brady Bonds remain a popular instrument for repaying the debt of developing countries even today.