Blue chips: advantages of investing in this type of stock

Blue chips are stocks of companies that have stable financial indicators and have been showing high returns for a long time. In most cases, we are talking about large corporations that have been present on the market for quite a long time. In addition, such companies pay dividends to their shareholders.

There are three key criteria by which shares of a certain business are classified as blue chip:

1. Publicity. These companies are popular in the marketplace and with investors, have a strong brand, and are trusted by consumers.

2. Safety. Investments in stocks are considered safe because they show stable and high results both in times of crisis and in periods of active growth. Despite market fluctuations, the company’s financial performance remains stable.

3. Authority. Often, these stocks are part of the global or major U.S. stock market indices. These companies have been in business for a long time.

Blue chip companies are leaders in their industry. Their high position is mainly due to their high profile and large market share.

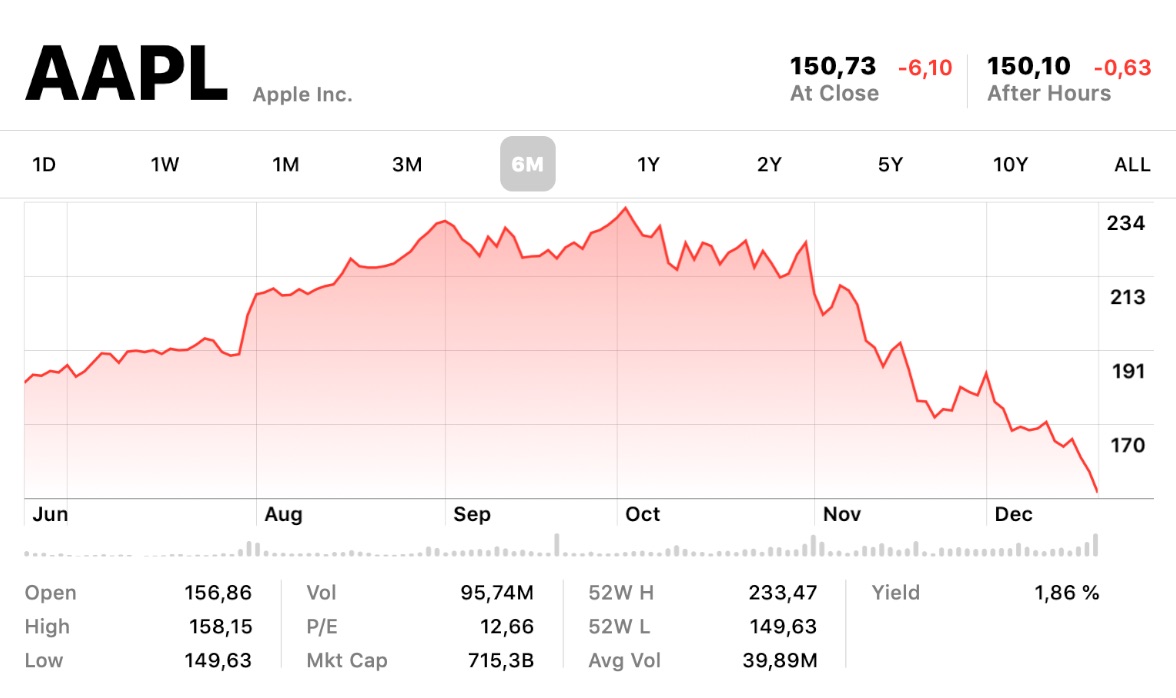

It should be noted that there is no official list of blue chips, but 30 companies included in the Dow Jones Industrial Average – DJIA – are considered as such. Among them are such famous giants as Apple, Microsoft, McDonald’s, Walt Disney, and others. The market capitalization of these companies is in the billions or even trillions of dollars, as seen with Apple. In 2022, its valuation exceeded 3 trillion dollars. Not surprisingly, many investors prefer to work with blue chip stocks. Investing in them offers high returns and stable dividend payments. Wyatt analyzed the performance of three U.S. companies: General Electric, AT&T, and Dupont. The experts compared the performance of the above companies with the results of the stock market dynamics during major crises in 1929 and 1987. According to the analysis, their performance remained more stable even during the collapse than that of other market participants. Moreover, these companies recovered more quickly than their less stable competitors.

Not surprisingly, many investors prefer to work with blue chip stocks. Investing in them offers high returns and stable dividend payments. Wyatt analyzed the performance of three U.S. companies: General Electric, AT&T, and Dupont. The experts compared the performance of the above companies with the results of the stock market dynamics during major crises in 1929 and 1987. According to the analysis, their performance remained more stable even during the collapse than that of other market participants. Moreover, these companies recovered more quickly than their less stable competitors.

However, it should be understood that even market giants can lose their status. Some may be excluded from the Dow Jones index, while others may be included. In addition, it is important to keep in mind that there are no clear criteria for which companies should be considered blue chips and which should not. In most cases, the Dow Jones is the main indicator.

Global stock indices, such as Europe’s EURO STOXX 50, include companies such as LVMH, Siemens, L’Oréal, Volkswagen, and others.