The difference between backwardation and contango: the peculiarities of the markets

The futures market has its own peculiarities, which should be taken into account when planning activities. And the situation can unfold in different ways, and you should be prepared for that. For example, it happens that the price of the commodity exceeds the futures rates, and there may be much more futures with a long lead time for the shipment of products with a short lead time. A backwardation is then said to be observed. This market condition occurs as a result of a serious shortage of goods available when their delivery terms expire in the near future. In this case, the market is inverted, or inverted, and then the premium on products can skyrocket.

The onset of backwardation increases the amount of speculative activity on commodity platforms. In addition, there is a decrease in hedging and a decrease in price stability. This situation is mainly inherent in the segment of perishable goods, such as agricultural products.

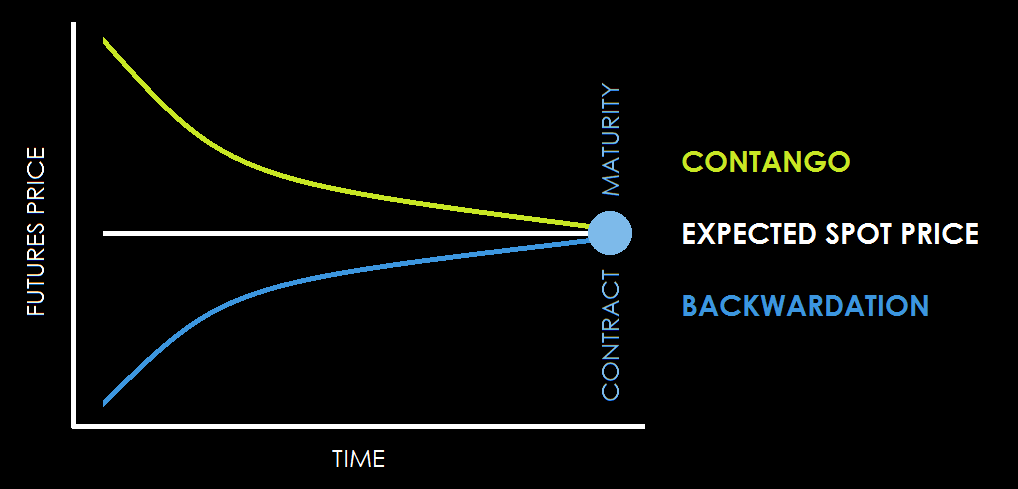

Backwardation is not a normal market condition. Usually, the price of futures on commodity exchanges is higher than at spot rates. In addition, the size of futures for longer maturities exceeds contracts for close dates. This distribution is called contango. It occurs when the supply volume of a commodity can cover demand and there is enough product inventory to adjust the price for near-dates. Contango characterizes segments with products with a long shelf life, such as cereals, soybeans, coffee, meal, sugar, oil, and others. This state of the market is also inherent in metals, oil, and petroleum products. At the same time, unlike the backwardation, the size of the premium for the sale of contracts with a long execution period is limited. It should not be higher than the costs associated with the goods, for example, its storage, delivery, insurance, and others. If the premium exceeds the number of costs, then the goods will be unprofitable to sell. Then it will be possible to buy products and leave them in storage until the contract arrives, which will give an opportunity to cover costs and make a profit.

Contango characterizes segments with products with a long shelf life, such as cereals, soybeans, coffee, meal, sugar, oil, and others. This state of the market is also inherent in metals, oil, and petroleum products. At the same time, unlike the backwardation, the size of the premium for the sale of contracts with a long execution period is limited. It should not be higher than the costs associated with the goods, for example, its storage, delivery, insurance, and others. If the premium exceeds the number of costs, then the goods will be unprofitable to sell. Then it will be possible to buy products and leave them in storage until the contract arrives, which will give an opportunity to cover costs and make a profit.

It should also be kept in mind that the prices of cash commodities and futures are closely related. They are influenced by the same factors, both internal and global. The dynamics are straightforward – spot prices increase, futures prices also increase, and vice versa, which allows you to keep the balance between profits and losses on both the one and the other markets.

The closer the term for the futures contract, the more its value aligns with that of the cash commodity. This is due primarily to the fact that storage costs are reduced.