Junk bonds: pros and cons of high-risk shares

Junk bonds are securities that are classified as speculative with low credit ratings. They have a bad reputation in terms of finance but are also highly profitable.

To increase their attractiveness among buyers, garbage bonds are issued at a high interest rate, which also helps the owner to buy back the company if it is on the verge of bankruptcy.

Working with such securities involves a high risk, but there is an opportunity to generate a good income. This can be seen when comparing junk bonds with safe shares. The forecasted yield on the latter is up to 10% per annum, and the benefit of investing in the former can be as high as 150-200%. However, it should be understood that in the case of junk bonds no one will guarantee that the company will repay the debt and the investment will pay off. Therefore, this type of bonds are purchased only by experienced investors after a thorough analysis of prospects and probable success.

A large share of the market is owned by unrated bonuses. According to S&P classification, only 1-2% of issuers have the highest rating and their securities are classified as AAA. These include large companies, which have stable capital and low leverage.

In most cases, companies resort to issuing garbage bonds, which want to attract the maximum amount of investment in a short time. These are companies that do not have significant positions in the market or their business reputation causes doubts. One more variant of release when the firm is in the course of absorption, and investors are given shares as an alternative to live money.

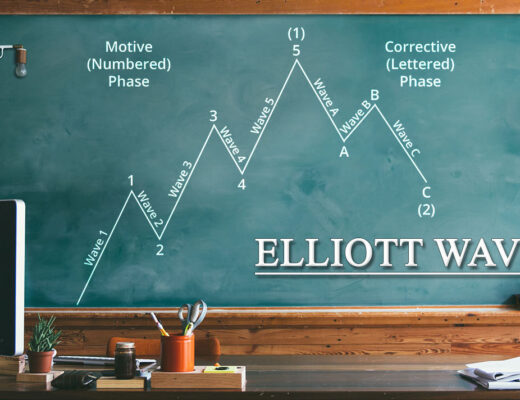

The history of junk bonds began in the 1970s in the United States. At that time, financier Michael Milken presented a comprehensive analysis without rating bonds. According to his research, a diversified portfolio of low-grade bonds, aimed at the long term, has a high risk of default. However, he can bring in large dividends compared to the shares, which have a high rating. Another peculiarity of junk bonds is that they are subject to cyclicality, which means that junk bonds are likely to grow significantly if the market for reliable securities falls.

Several types of companies are issuers of junk bonds. The first are new projects that are just developing. They do not have the right amount of assets and stability, so their investment rating is extremely low.

The second option is “Fallen Angels”. This is a business that used to be stable, but now is experiencing great difficulties. High-debt companies – this includes companies with debts or in bankruptcy proceedings. Capital-intensive companies – firms that do not have enough money to cover their business processes or loans.