John Templeton and his professional philosophy

John Templeton is one of the pioneers of trading and investing. His financial strategy still resonates with his contemporaries. Despite his professional success, Templeton did not limit himself to the market. He was an avid traveller and established a charitable foundation to promote science.

The investor was born in Tennessee in 1912. He graduated from the prestigious Yale University in 1934. John later earned a law degree from Oxford.

Early career

Templeton went to Wall Street rather than pursue a career in law. While working with investments, he developed his trading strategy. Its key aspects:

– the value of stocks had to be considered separately from the impact of general market trends;

– the financier looked for stocks that other investors considered unpromising;

– distressed companies were growth opportunities;

– stocks that were previously expensive deserve attention;

– the investor kept an eye on them to profit when they fell.

A keen traveller, Templon actively sought out foreign markets. He did not confine his activities to the US stock market and looked for opportunities to make money abroad.

When the Second World War broke out, John decided to take action. He bought 100 shares in 104 companies, selling them at one dollar each. He had to borrow money to do this, but the risk paid off handsomely. After a while, only 4 companies were unprofitable and the rest made the investor a huge profit.

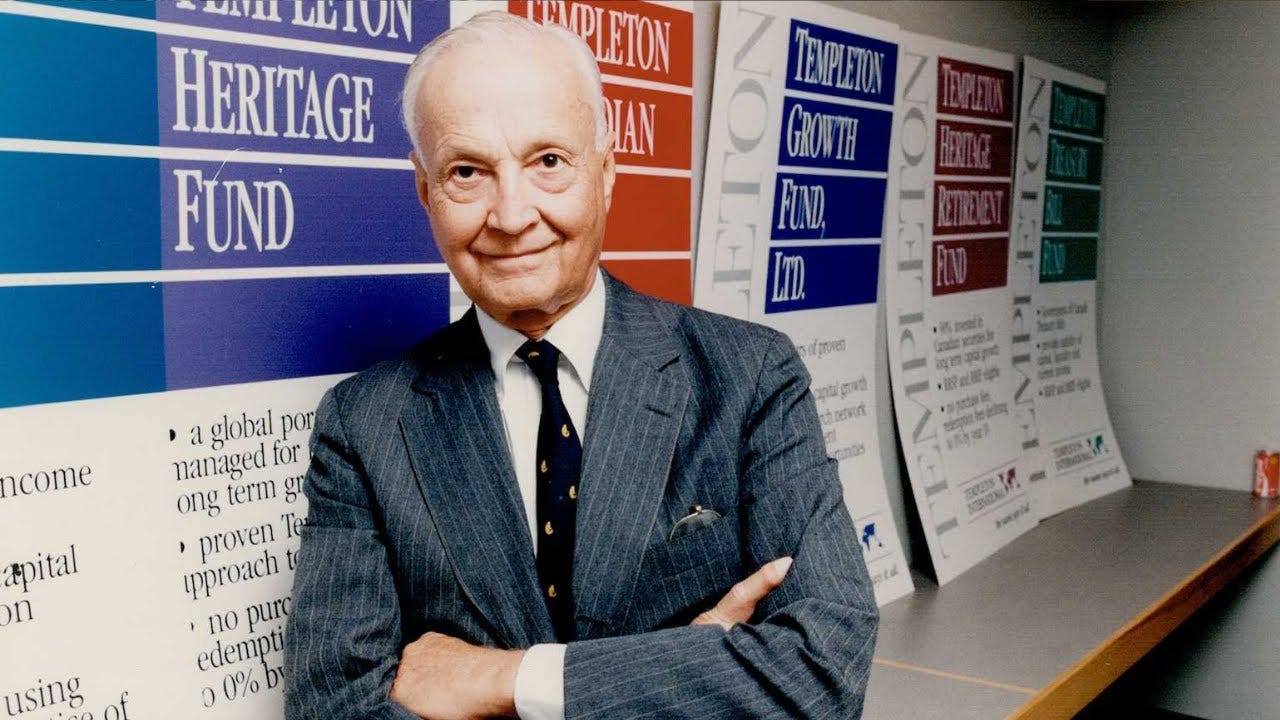

Own business

In 1940, John bought a company that became the basis of his investment business. He later set up the Growth Fund, which grew rapidly. In the 38 years of its existence, its profitability was around 15%. Templon was one of the few financiers to invest in emerging markets in the 1960s. For example, he was one of the first to recognise the prospects for Japanese equities. In 1999, Money magazine named Templeton a global stock picker.

John took his own company public in 1959. At the time, he had US$66 million under management. The IPO allowed him to launch 5 other funds in the nuclear, electronics and chemicals sectors. In 1992, Templeton sold his firm to Franklin Resources. The transaction was worth US$913 million.

Philanthropic activities

In 1987, the investor established a charitable foundation and the Templeton Award. The prize was intended to honour those who had made significant contributions to the advancement of science and the solution of social problems. The prize included a cash award of £1 million. Achievements in the field of spiritual development and the understanding of man’s place in the universe were the most important considerations.

After John’s death in 2008, his granddaughter Heather Templeton Dill took over the running of the foundation.