What strategies include high-frequency trading

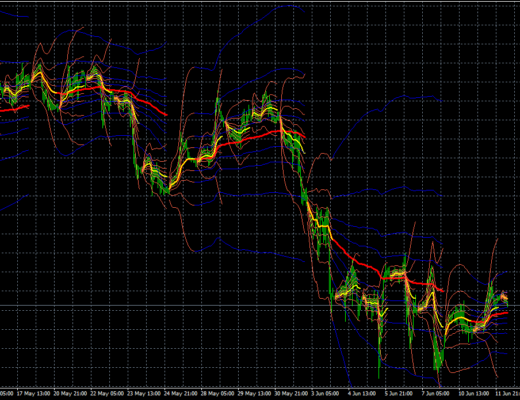

The development of technology has made it possible to automate processes in many areas, including exchange trading. Thanks to innovations, such a trend as high-frequency trading has emerged. One of its features is the high speed of opening and closing transactions, which takes only a few milliseconds.

These functions are assumed by a special program, which can make decisions as quickly as possible. But do not think that speed is the only advantage of high-frequency trading. In this case, the fact that the broker receives information about quotes and other important information faster than others plays a decisive role.

Using this approach, it is possible to catch the dynamics of the market, and its changes long before it becomes known to a wide audience. It should be noted that high-frequency trading is common in companies and funds that are close to stock exchanges. They have direct access to the platforms, which gives them the opportunity to learn about changes faster than other traders and without intermediaries. This mechanism is used for trading activities with underlying assets, which include stocks and futures.

In terms of earning, the use of high-frequency trading has its own peculiarities. The program allows you to open a large number of deals in a second, but the profit from them can be low. If a broker wants to get serious money, he must open a position for a large stake, and it is associated with risks. There are several strategies in this approach:

There are several strategies in this approach:

1. Classic arbitrage. The trader tracks the similarities in the behavior of an asset on different exchanges. The program detects that the price has changed on one of the exchanges, and opens a deal.

2. High-frequency trading as a liquidity option. Companies that employ this strategy are located near exchanges. Having direct access to information, they can provide liquidity to other brokers. In this case, they take a fee in the form of a spread.

3. As a way to get information to get ahead of the competition.

4. Identification of hidden orders from large traders. The program makes orders in small volumes and at the same time changes the time of their closing. The faster the algorithm carries out such operations, the more likely it is that the competitor is a major player who opens orders for large volumes. Accordingly, its actions affect the changes in quotations.

High-frequency trading has a number of disadvantages, first of all, we are talking about high risks with large lots. It should also be taken into account that the algorithm can fail. Then a huge number of orders, which are opened in a few seconds, will turn into serious losses for the company.