Why it is important to control the equity level when trading on the stock exchange

Equity is the amount of money in a trader’s account. It also considers the total financial result of the currently open positions. This parameter lets you see the current balance and the remaining amount after closing trades. The higher the equity is, the more funds the player has to carry out the operation. The trader may need additional collateral or a margin call if the indicator decreases.

When working on the exchange, it is also essential to understand some terms that will help you navigate better:

1. Equity balance value. It shows the state of the account when there are no trades in open positions. This indicator is similar to the concept of balance. If there are no open trades, this amount will not be available for withdrawal or transfer from the account.

2. Floating equity value. It shows the current value of the trader’s funds on the market, taking into account open positions and their price changes in real time. This value reflects the net value of all open trades and is maintained by the trader during trading.

A trader may have a negative equity value:

1. At the time of opening a trade. The broker considers the spread automatically set on the financial balance. You will not have made any money on the trade, and the spread will be negative. In the case of a negative value, the equity is the value of the total balance minus the spread.

2. In the case of a total loss on trades. For example, the profit from 3 open trades was US$5 each. And the next deal ended with a loss of US$30 together with the spread. Then, the total loss will be -5 dollars. Accordingly, with a balance of US$1,000, the equity will be US$995.

It is important to understand that this parameter should always be above zero. Otherwise, the account balance will appear to be negative. The broker closes transactions when it approaches zero to prevent such a situation. This option is available through the stop-out mechanism. It works automatically.

Why it is necessary to analyse the dynamics of the indicator

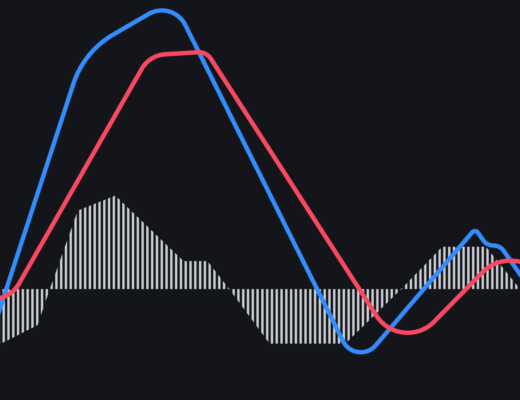

The change in the indicator allows you to assess the strategy’s effectiveness. A sharp decrease in the parameter indicates risks, intensive growth, and further decrease – high volatility.

Analysis of the equity rate of change helps the trader identify the problem in time. It is especially relevant when using several financial instruments. In addition, monitoring the indicator allows better control of the situation and increases the chances of success.

When trading on the stock exchange, a trader must have a certain amount in his account. Its size allows it to open new deals based on risk management. It is crucial to balance the planned profit and risks for each transaction. The main objective is to maximise profit at a risk level of up to 15% of the deposit. In addition, a smoothly rising equity curve, with no dips or peaks, is ideal.