American Depositary Receipts: benefits for companies and investors

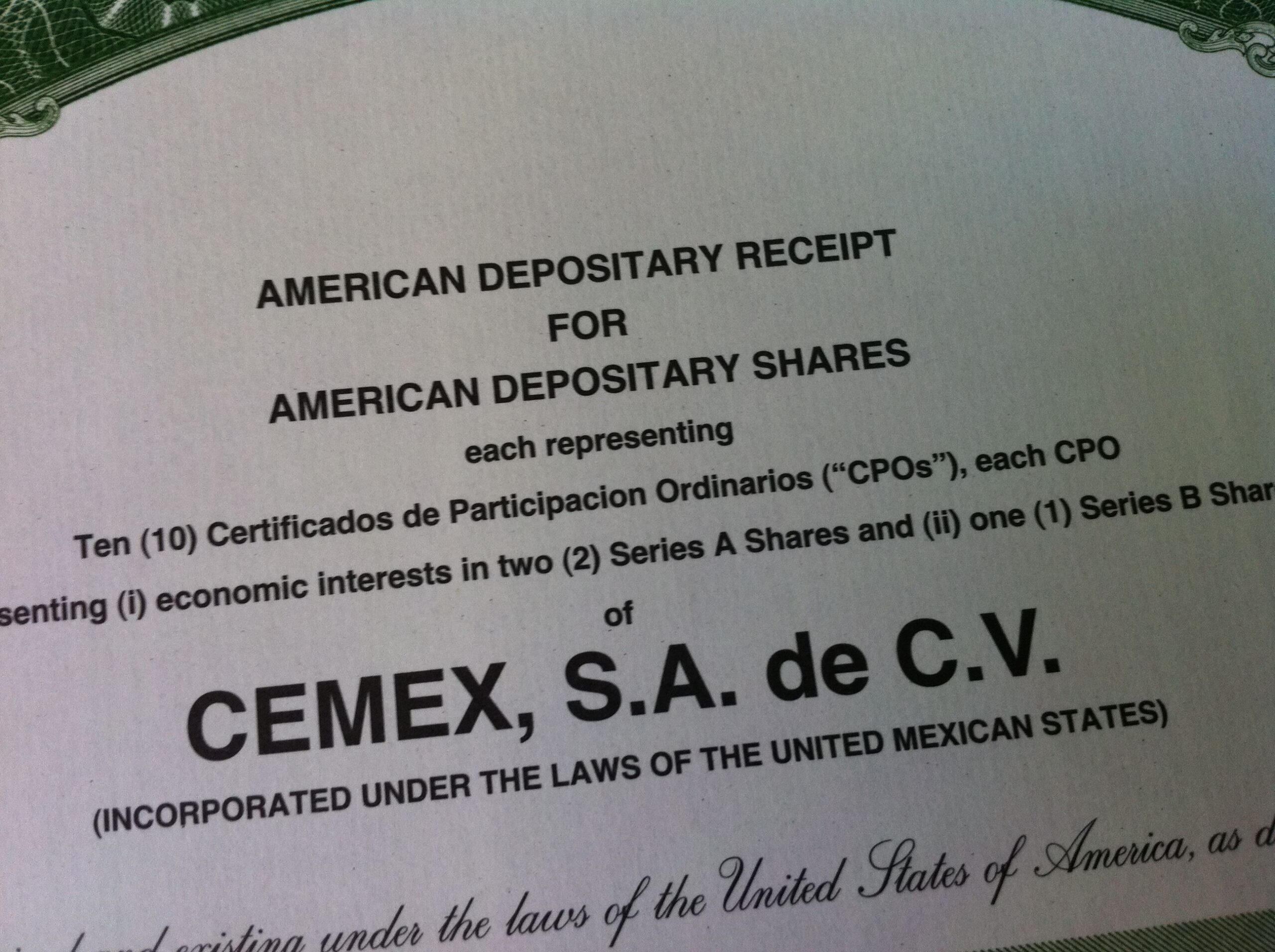

American Depositary Receipts (ADRs) are US depositary receipts available on all US stock exchanges. They can represent one or more company shares incorporated outside the United States. A multiplier is applied to give the security a standardised price for the US market. The ADR trading process consists of several steps:

– a foreign company places its shares with a US bank;

– once the financial institution has issued the certificates, they become available for purchase in dollars;

– dividend payments on the securities are also made in dollars.

This procedure simplifies operations for US investors and saves them from having to make payments in foreign currency.

The first depositary receipt was issued in 1927, and there are currently more than 2,000 units in circulation from companies in over 70 countries.

What are ADRs used for?

Depositary receipts are a convenient way for investors and companies to operate in the market. In the case of the former, an investor from the United States invests in the shares of a foreign company without the added hassle of different currencies or the rules of other stock exchanges. In this case, companies from different countries have the opportunity to enter the US market. One party can diversify its portfolio, and the other can increase investment to scale. As a result, foreign giants such as Alibaba, Shell, Sony and others have a presence in the US market.

Types of US depositary receipts

There are two main types of ADR:

1. Sponsored. Issued by a bank on behalf of the company itself, based on an agreement whereby the foreign company bears the cost of issuing the securities. The bank undertakes to monitor the transactions. The classification of sponsored ADRs is on the basis of the foreign company’s compliance with SEC rules and US accounting standards.

2. Non-sponsored depositary receipts. In this case, a US bank handles the issuance of the securities, and it does not need permission or company participation. Several financial institutions may issue ADRs of this type for a single company. As a result, dividends may vary.

Sponsored receipts are available on all US exchanges and approved by the relevant commission. Non-sponsored receipts are only available in the over-the-counter market.

ADRs are attractive to US investors as a long-term investment. In addition, the interest rate on bank deposits is close to zero. This makes it possible to protect funds from the effects of inflation, which continues to rise.