How system trading is applied and its main points

Trading on the exchange implies carrying out a number of operations for the purpose of making a profit. However, you should be prepared for the fact that not all transactions are guaranteed to bring income. In order to minimize losses and multiply received funds, it is necessary to build a certain scheme of action. System trading which assumes carrying out of trade according to strict rules is a great help in that. The rules are based on the methods of market analysis, including fundamental analysis, factor analysis and others.

Beginner traders often act intuitively, which often does not lead to the necessary result. At the same time systematic approach allows to trade with clear structure, where it is necessary to:

– determine the entry point to a particular position;

– to indicate the approximate goal of where the asset is moving, as well as the amount of desired profit;

– fix a possible loss in case of force majeure;

– choose a way to control the position, to track changes in the size of profits and losses;

– analyze the risks, taking into account the various criteria that affect the position.

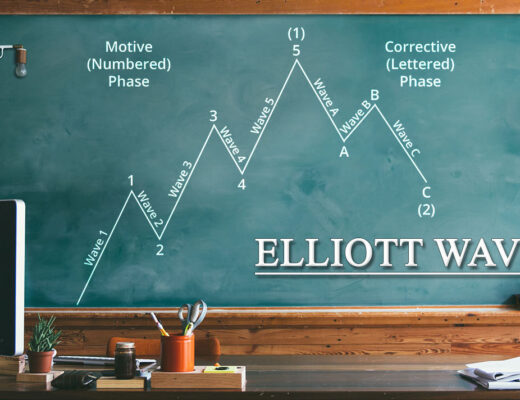

It should be noted that the fundamental analysis of the market is used very rarely, it is easier to use the model “buy when it goes up, sell when it goes down”. The financial analysis is also not quite suitable, it is rather necessary for calculating profits in the long term. That’s why the most popular approaches among traders are considered to be factor and technical analysis. The basis of the technical option of studying the market is the principle that everything repeats itself. It means that the approach that brought a profit in the past may work this time as well. This rule can be put into a special program and start calculating possible trading results for these or those averages. In addition, technical analysis tools allow you to create a decision-making scheme based on the values of a breakout or rebound from resistance or support limits. With such an approach, you can get important components that allow you to apply the principles of systematic trading. And the more different data a player has, the higher the chance of making a profit and not losing money.

The basis of the technical option of studying the market is the principle that everything repeats itself. It means that the approach that brought a profit in the past may work this time as well. This rule can be put into a special program and start calculating possible trading results for these or those averages. In addition, technical analysis tools allow you to create a decision-making scheme based on the values of a breakout or rebound from resistance or support limits. With such an approach, you can get important components that allow you to apply the principles of systematic trading. And the more different data a player has, the higher the chance of making a profit and not losing money.

Factor analysis is the study of various events that affect price movements. It is based on the principle “buy based on rumors, sell when there are facts”. Modern programs make it possible to construct a market model where statistical factors and probable variants of processes development are taken into account.

The key advantage of following the concept of systematic trading is the exclusion of a human factor. Thanks to the fact that in this case activity is not based on emotions but on facts the psychological tension is reduced. It allows evaluating the situation soberly, searching for the best variant of solving the problem and, if necessary, acting quickly.