How to use a fractal to analyse market trends

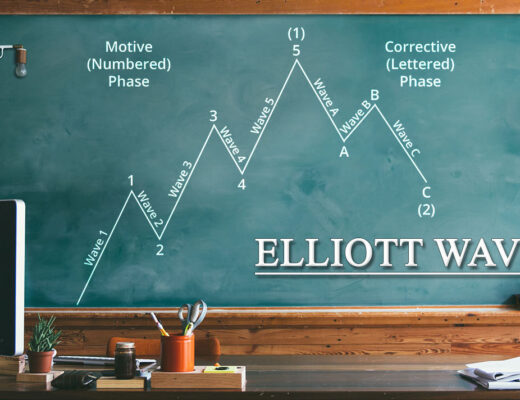

A fractal pattern is a formation of 5 candlesticks with the third candle in the middle. It either has a higher High price than the two candles to its left and right or a lower Low price. The pattern is formed due to the efforts of sellers or buyers to influence the price and move it in the right direction. But these attempts fail, and the price rolls back. If the subsequent fractal exceeds (or falls below, depending on the type) the level of the previous fractal, it may signal the possibility of a new price movement. By analysing the type of pattern, you can predict the market dynamics.

Stock trader Bill Williams introduced the concept of the fractal. His system considers the fractal bearish when the third candle exceeds the other two. The V-shape indicates a bullish trend.

Note that the pattern does not necessarily consist of 5 candlesticks. In this case, three candlesticks would be a weak signal, and seven would delay the signal. In addition, the 7th candle may become the point at which you should open a position. Therefore, five candlesticks are considered the best option.

It is important to understand that fractals are based on highs and lows, not on opening or closing prices. Therefore, in most cases, the pattern is not perfectly formed. Sometimes, a candlestick can be both a high and a low at the same time. It is better to ignore such a pattern as it does not carry any useful information.

Fractal indicator

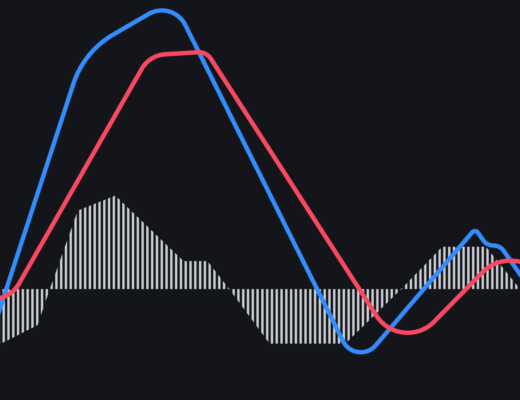

The indicator tracks the emergence of patterns and marks them with ‘up’ or ‘down’ arrows. The main advantage of the tool is that it visualises a candlestick when the pattern itself is not yet fully formed. In this way, the indicator warns the trader of the dynamics. However, to display resistance and support levels, the tool only considers one signal – the average candlestick. Other important indicators are ignored, which can distort the real picture of the trend movement.

There are several types of indicators which differ in the presence or absence of filters and additional settings. They work for different time frames and market dynamics.

The pros and cons of fractals

Traders widely use fractals for a number of reasons:

– they highlight flat zones and resistance/support points;

– signal conditions for opening a trade;

– show landmarks for setting stops;

– make it easier to find the points at which the price should turn.

However, you should not rely on fractals alone, as they have disadvantages as well as advantages:

– they can give false signals;

– it is better to follow fractals without indicators that do not take into account additional signals;

– are subject to price noise (when working with short fractals);

– signals can come late, after the formation of the 5th candle.

Taking all these nuances into account, it is better to use fractals as an additional tool to analyse the market rather than as the basis of a trading strategy.