Awesome Oscillator: peculiarities of using the indicator

The Awesome Oscillator is a fundamental indicator used in intraday trading strategies. It helps traders analyse the momentum and determine the likely period of trend reversal. Due to its ease of use, this indicator has proven to be a popular tool among market participants.

The indicator appeared thanks to trader Bill Williams. Its functionality is based on the contact and divergence indicators of moving averages. The algorithm of actions is as follows:

– a fast-moving average with a period of 5 is selected;

– the slow-moving average should have a period of 34;

– the value of the slow-moving average is subtracted from the fast-moving average.

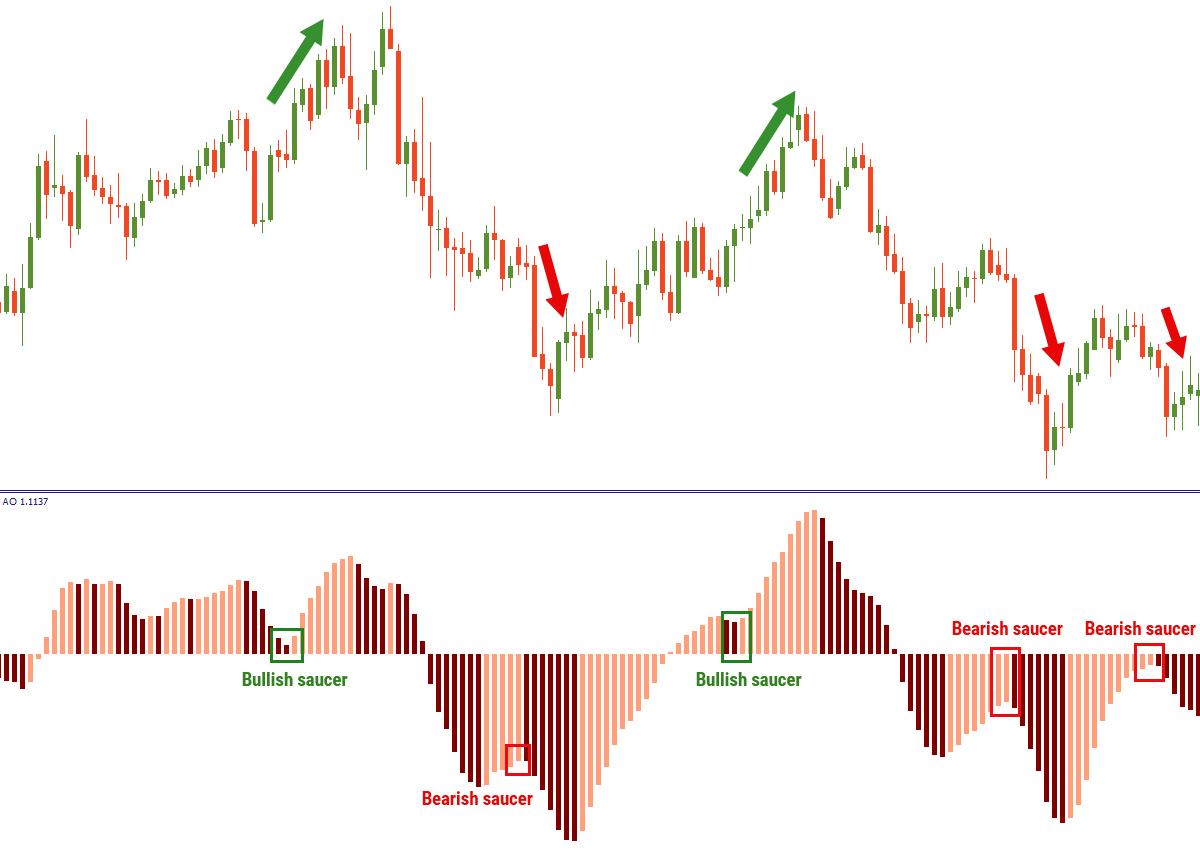

The category of this oscillator depends on the dynamics of the volatility. If the volatility is moderate, it belongs to the leading indicators. If the volatility is high, it is considered a lagging indicator. Visually, a histogram with two columns—red and green—represents the oscillator. In an uptrend, the columns grow upwards, and in a downtrend, they grow downwards. The length of the bars and their divergence depend on the strength of the trend.

How to work with the indicator

The Awesome Oscillator was initially developed for use in the stock market. Over time, traders began to use it on various trading platforms. As a result, the indicator has proven its effectiveness in almost all financial markets, especially in the currency market. However, when working with the oscillator, it should be understood that it is an additional tool.

The use of the indicator implies the observance of a number of rules, including:

– it is important to regularly compare the current dynamics with the past indicators of the indicator;

– in case of atypical deviation of indicators from the zero line, it is possible to assess the possibility of price reversal as high;

– the size of the columns also deserves attention: their rapid growth indicates the strengthening of the trend;

– the basic settings allow the oscillator to fix short-term impulses.

You can use the pattern with various instruments, including trend displays. If both types of indicators are pointing in the same direction, then it is a good idea to open a trade. At the same time, it is important to use tools that help distinguish a reversal from a correction. One of these is the RSI.

The awesome oscillator shows good results when combined with horizontal and vertical volume indicators, which traders see as a good thing.

In general, we can note the versatility of this indicator. It is perfectly suitable for various trading strategies, both short-term and long-term. Moreover, working with it does not require any special skills. The oscillator can become an assistant for beginners who are experimenting in search of an optimal approach. However, it is essential to keep in mind the risks that always accompany a trader. It is vital to remember that there are no tools that provide guaranteed true information. Each of them requires additional verification.