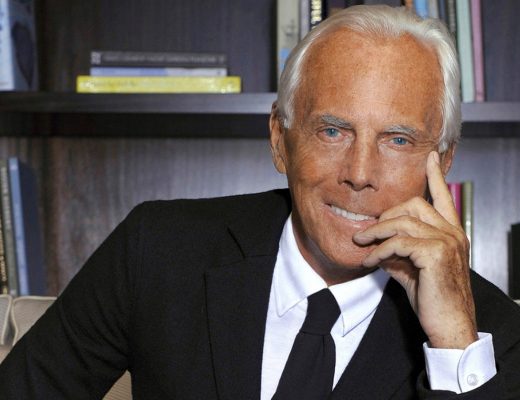

William O’Neill is a famous exchange expert who has developed his unique approach to trading. He succeeded by his own efforts, learning from his mistakes and turning losses into valuable experience.

William O’Neill: the way to success through learning and persistence

William O’Neill wrote the book “How to Make Money in the Stock Market”, which shows his approach to trading operations. But before earning his fame and respect, a broker had to face difficulties.

O’Neill comes from a poor family and to help his parents, he was working as a part-time job from an early age. After graduating from university and serving in the army, William began to study stock exchange engineering. He was primarily interested in futures and read a lot of literature on the subject.

His persistence produced results and the young man was hired by a small firm as a financial analyst. In this position, he could experiment and look for his own approach. William focused all his efforts on creating a computerized investment system. At that time, this principle was hardly ever used, and therefore there was no competition.

O’Neill’s cases were going well. He proved himself among his colleagues and clients as an experienced financial expert whose actions brought high returns.

At the age of 30, William acquired a place on the New York Stock Exchange, and later founded his own investment company.

Thanks to the right trading strategy, O’Neill was successful and, importantly, earned a reputation in financial circles. His approach was described in a book by an exchange consultant. But we should not be forgotten that an individual strategy can work in one case, but become completely useless in another. Therefore, each beginner broker must find his own way.

The trading system, founded by William O’Neill, is called CAN SLIM. It is an abbreviation, which includes the basic rules of success for exchange operations.

System decryption:

- the minimum quarterly profit percentage should be at least 14%.;

- 25% minimum annual income is 25%;

- pay attention to new investment proposals that are in high demand;

- strive for high transaction volumes;

- aim to become a market leader;

- the number of big companies should be growing all the time.

William O’Neill considered regular trend growth to be the main rule for successful investment. This is especially important when investing in shares, not in currencies.

An exchange expert is not a supporter of buying cheaper assets, which he compares with sales. These deals are not profitable from the very beginning.

Now William O’Neill advises traders, conducts analysis of companies in order to determine their profitability.