Martingale strategy: advantages and disadvantages

Martingale strategy is a trading tactic in which a trader doubles their bet after each losing trade. The purpose of this tactic is to compensate for previous losses and make a profit.

The strategy was originally popular in gambling. In particular, it was often the case in bets on coin tosses, where the profit depended on a certain side coming out. Later, with the development of financial markets, this approach became adapted to trading. Today, it finds its use in stock exchanges, including cryptocurrency platforms.

Strategy overview

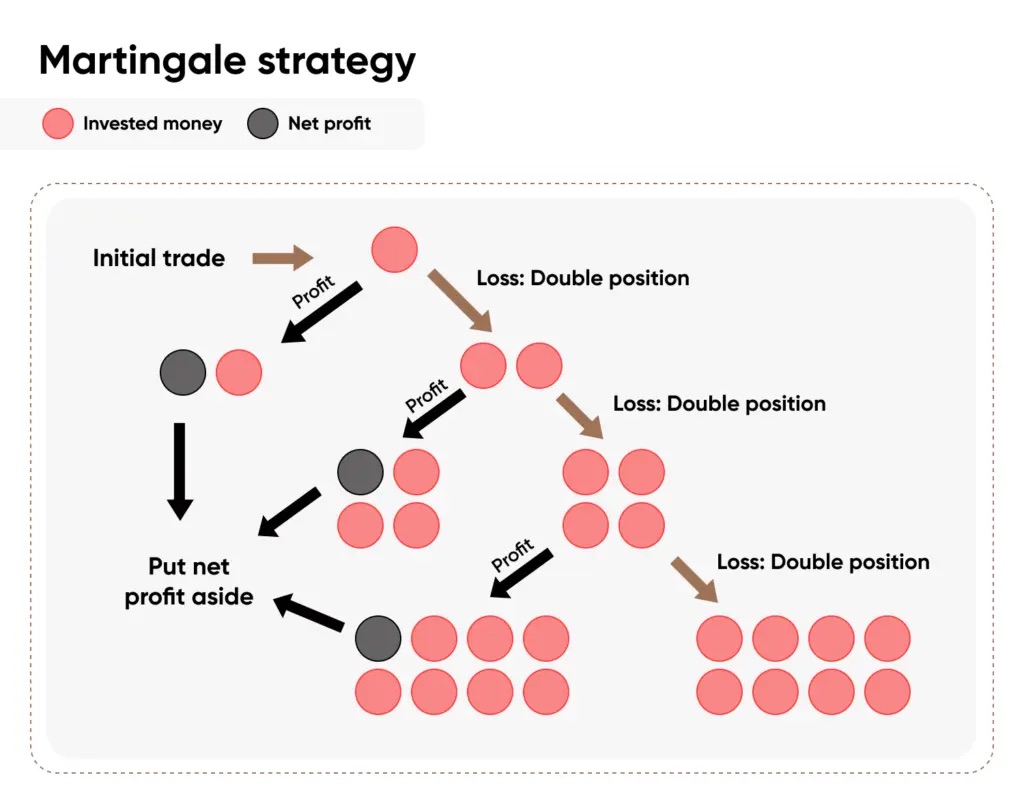

The principle of the strategy is as simple as possible and includes a number of stages:

1. The trader starts trading with a minimum bet, you can also use a deposit.

2. In all cases, when the trade ends unsuccessfully, the subsequent bet will be twice as high.

3. This tactic is used until the trader reaches a level of profitability.

4. At the same time, the trader must earn enough to make a profit and cover previous losses.

It is important to realise that this strategy does not guarantee profit. Ill-considered actions can lead to large financial losses. In most cases, investors will see modest returns as profits are irregular. However, with the right approach, the strategy allows you to redistribute profits and partially offset losses.

The Martingale strategy is spread across different sectors. In casinos, the tactic finds application in games with equal odds, such as roulette. It is also popular in financial markets and cryptocurrency exchanges.

Advantages and disadvantages

One of the main advantages of this strategy is its simplicity. It does not require in-depth knowledge of the market, analysing the nuances and taking into account the peculiarities of the exchange. This approach can be useful for novice traders as it is based on the intuitive principle of doubling the bet after each losing trade.

Investors also appreciate the strategy for its stability and the rigour of the algorithm. There is no need to constantly analyse the market situation or follow trends. It is enough to strictly follow a predetermined sequence of actions. The main principle is based on a mathematical calculation: one profitable trade should cover all previous losses.

The Martingale strategy is effective in the short term. However, it should be clear that it requires a certain amount of capital for its implementation. It is significant to consider possible risks: a series of losing trades may be long and require significant resources. In such situations, it is necessary to abandon the strategy in time to avoid critical financial losses.

When implementing a strategy, it is essential to take into account the rules of the market. We are talking about betting limits in casinos and margin norms on financial platforms. In addition, high leverage increases the risks as the amount of losses can exceed the initial investment.