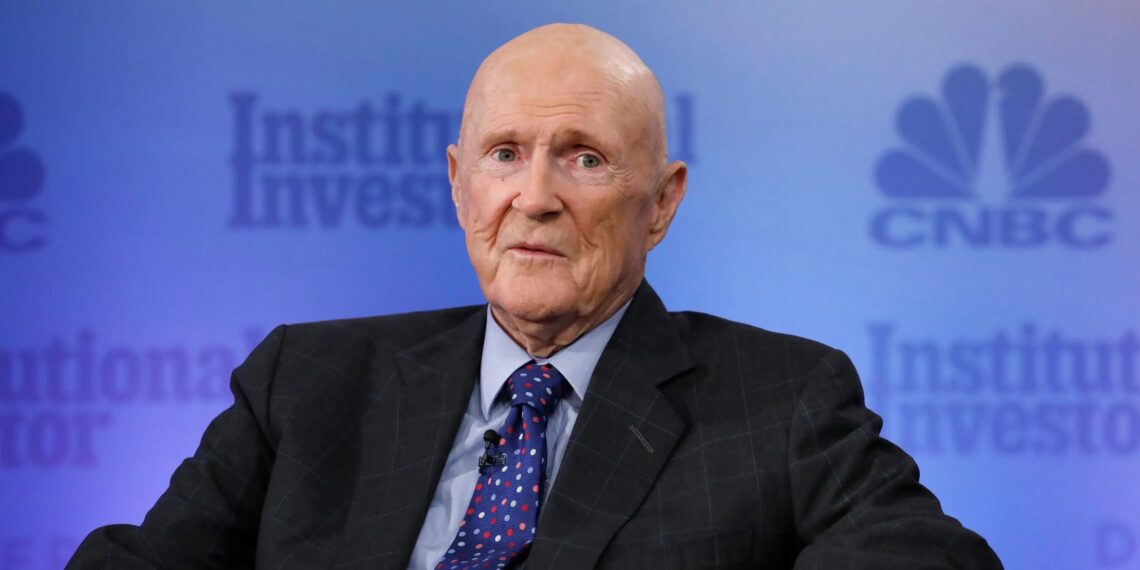

How Julian Robertson made billions and then lost them

Stock market activity is an opportunity to make a huge profit and then lose it immediately. It is associated with ups and downs, and no one is safe from failures here – neither a beginner nor an experienced investor. A striking example of how one can achieve much and lose everything is Julian Robertson. At one time he set up one of the first hedge funds, which was record profitable. However, it had to be closed with the loss of most of its assets.

Robertson’s childhood and youth were quite typical. He was born in 1932, after graduating from school he went to university, and then he went into the army. After serving two years, Julian decided to try himself in the financial world and got a job as an employee in an investment company, where he worked for about 20 years, reaching the position of division manager.

The turning point for Robertson came in 1979 when he decided to take a break from work and moved with his family to New Zealand for a year. At the age of 47, Julian made a dramatic change in his life, and back in New York, Julian set up his own company, Tiger Management. In 1980, it was one of the first hedge funds with an initial capital of $8 million. The investors were friends and relatives of the businessman. By 1996, the company’s assets had grown to $7.2 billion, and two years later, to $22.8 billion. Robertson had unique mathematical skills, which helped in his investment activity. In addition, he accurately predicted the dynamics of quotations, due to which the fund managed to increase profits even in 1987, which was considered a crisis year.

Robertson had unique mathematical skills, which helped in his investment activity. In addition, he accurately predicted the dynamics of quotations, due to which the fund managed to increase profits even in 1987, which was considered a crisis year.

Julian followed an authoritarian management style, which later backfired on him. Focusing on currency trading and bonds, by 1994 the businessman reduced investments in stocks. As a result, the fund began losing profits, and with it, its clients. Despite the fact that Julian brought in outside managers to solve the problem, he could not take others’ opinions, and the company started losing not only money but also partners and investors.

In 1998, the fund reached its peak in terms of assets and took the lead in the market, but from then on the company was gradually heading for collapse. A series of unsuccessful deals, betting on the fall of the technology sector led to record losses. As a result, Robertson had to close the fund, returning some capital to clients. The investor had always acted with an eye to logic and rational market movements, but in a rapidly evolving technology sector, this approach became ineffective.

Despite the fund’s closure, Robertson continued to invest, but only with his own funds. His fortune is now estimated at $4.4 billion.